Growing Healthcare Expenditure

The US Sleep Apnea Devices Market is benefiting from the rising healthcare expenditure in the United States. With healthcare spending projected to reach approximately $6 trillion by 2027, there is a significant increase in investments directed towards sleep health and related technologies. This financial commitment from both public and private sectors is facilitating the development and distribution of advanced sleep apnea devices. Furthermore, insurance coverage for sleep apnea treatments is expanding, making these devices more accessible to patients. As healthcare systems prioritize preventive care and chronic disease management, the demand for effective sleep apnea solutions is expected to rise, thereby propelling market growth.

Rising Prevalence of Sleep Apnea

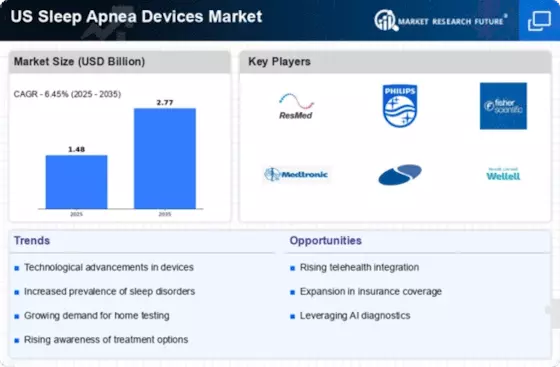

The US Sleep Apnea Devices Market is experiencing growth due to the increasing prevalence of sleep apnea among the population. Recent estimates suggest that approximately 22 million Americans suffer from sleep apnea, with a significant portion remaining undiagnosed. This rising incidence is prompting healthcare providers to seek effective treatment solutions, thereby driving demand for sleep apnea devices. The growing awareness of the health risks associated with untreated sleep apnea, such as cardiovascular diseases and diabetes, further emphasizes the need for timely diagnosis and intervention. Consequently, the market for sleep apnea devices is likely to expand as more individuals seek diagnosis and treatment options, leading to increased sales of CPAP machines, oral appliances, and other therapeutic devices.

Increased Focus on Preventive Healthcare

The US Sleep Apnea Devices Market is also influenced by the growing emphasis on preventive healthcare. As healthcare providers and policymakers recognize the importance of early diagnosis and intervention in managing chronic conditions, there is a concerted effort to promote awareness about sleep apnea. Campaigns aimed at educating the public about the symptoms and risks associated with sleep apnea are gaining traction. This heightened awareness is likely to lead to an increase in screening and diagnosis rates, subsequently driving demand for sleep apnea devices. The proactive approach to health management is expected to create a favorable environment for market expansion, as more individuals seek effective treatment options.

Regulatory Support for Device Innovation

Regulatory support is a crucial driver for the US Sleep Apnea Devices Market. The Food and Drug Administration (FDA) has been actively involved in streamlining the approval process for new sleep apnea devices, encouraging innovation and market entry. This regulatory environment fosters competition among manufacturers, leading to the development of more effective and diverse treatment options. Additionally, initiatives aimed at improving patient access to these devices, such as reimbursement policies and guidelines for healthcare providers, are further enhancing market dynamics. As regulatory frameworks continue to evolve, they are likely to support the introduction of novel technologies, thereby contributing to the overall growth of the sleep apnea devices market.

Technological Innovations in Treatment Devices

Technological advancements play a pivotal role in shaping the US Sleep Apnea Devices Market. Innovations such as the development of portable and user-friendly CPAP machines, as well as the introduction of adaptive servo-ventilation devices, are enhancing patient compliance and comfort. Moreover, the integration of smart technology, including mobile applications that monitor sleep patterns and device usage, is becoming increasingly prevalent. These advancements not only improve the efficacy of treatments but also attract a broader consumer base. As a result, the market is likely to witness a surge in demand for these technologically advanced devices, which are designed to provide personalized treatment options and improve overall patient outcomes.