Technological Advancements

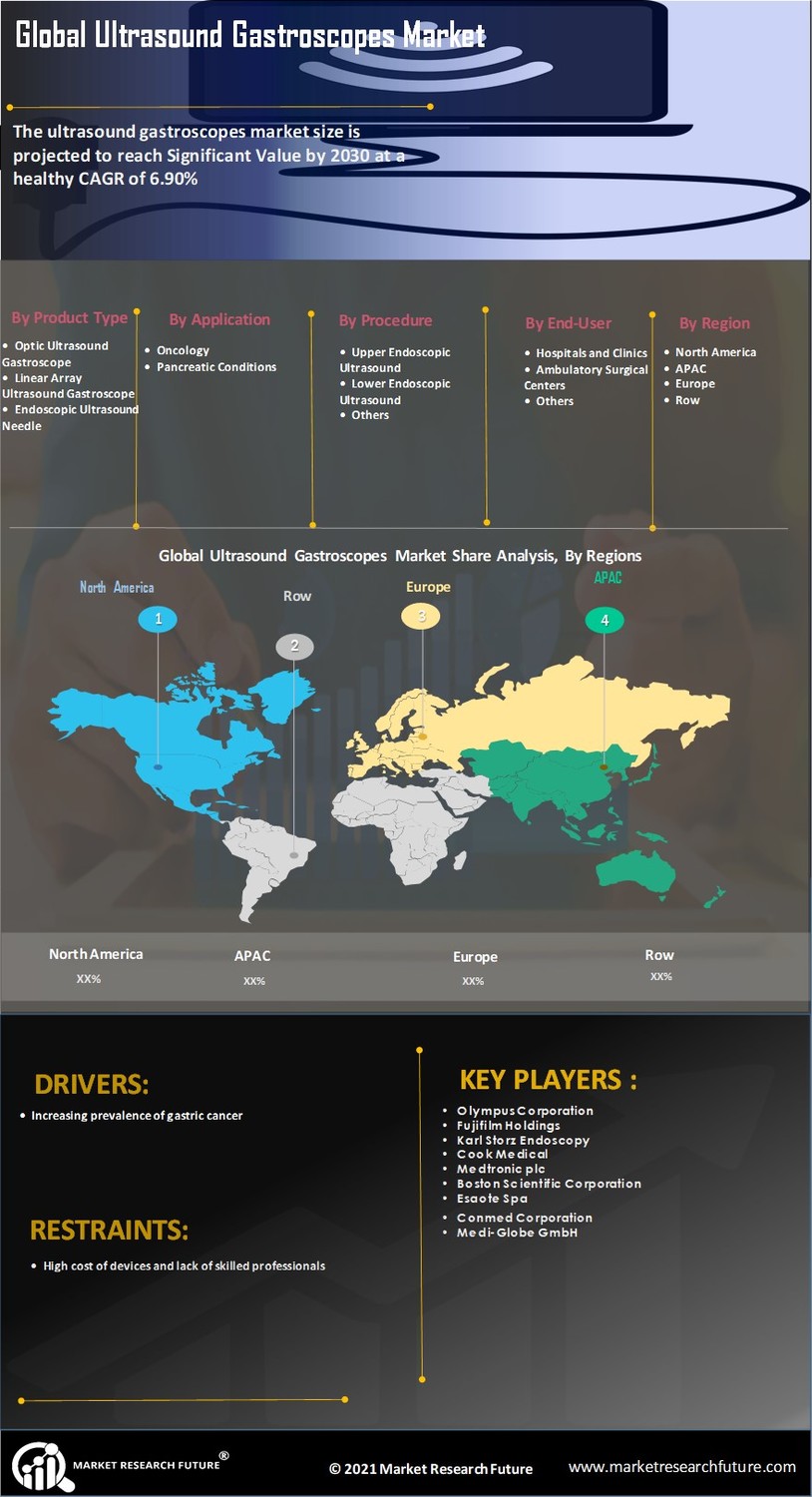

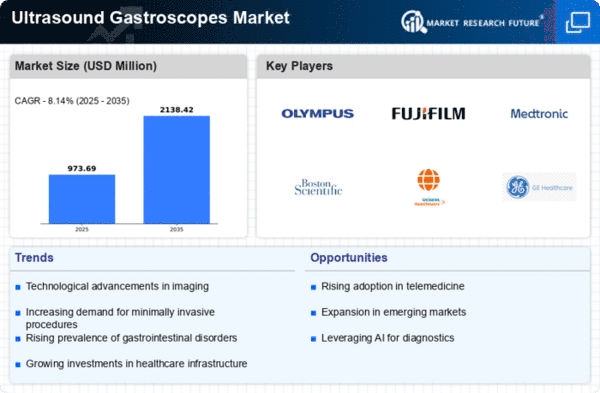

The Global Ultrasound Gastroscopes Market Industry is witnessing rapid technological advancements that enhance diagnostic capabilities. Innovations such as high-resolution imaging and improved ultrasound frequencies allow for better visualization of gastrointestinal structures. These advancements not only improve the accuracy of diagnoses but also increase the efficiency of procedures. As a result, healthcare providers are increasingly adopting these advanced gastroscopes, leading to a projected market growth from 0.7 USD Billion in 2024 to 1.16 USD Billion by 2035. This growth reflects a compound annual growth rate (CAGR) of 4.69% from 2025 to 2035, indicating a strong demand for advanced ultrasound technologies in gastrointestinal diagnostics.

Growing Awareness and Acceptance

There is a growing awareness and acceptance of ultrasound gastroscopes among healthcare professionals and patients alike. As more practitioners recognize the benefits of non-invasive procedures, the demand for ultrasound gastroscopes is likely to increase. Educational initiatives and training programs are enhancing the understanding of these technologies, leading to wider adoption in clinical settings. This trend is reflected in the Global Ultrasound Gastroscopes Market Industry, where increased acceptance is driving market expansion. As healthcare providers become more familiar with the advantages of ultrasound technology, the market is expected to grow steadily, aligning with the projected figures of 0.7 USD Billion in 2024 and 1.16 USD Billion by 2035.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure and access to advanced diagnostic tools are playing a crucial role in the growth of the Global Ultrasound Gastroscopes Market Industry. Many governments are investing in healthcare technology to enhance patient care and outcomes. Funding for research and development of innovative medical devices, including ultrasound gastroscopes, is increasing. These initiatives not only support the advancement of technology but also promote the adoption of these devices in clinical practice. As a result, the market is likely to benefit from increased investment and support, contributing to its projected growth trajectory over the coming years.

Market Expansion in Emerging Economies

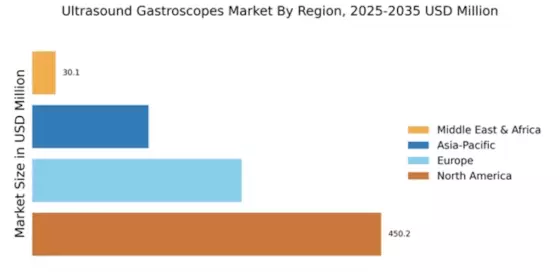

Emerging economies are experiencing rapid growth in healthcare sectors, which is positively impacting the Global Ultrasound Gastroscopes Market Industry. As these regions invest in healthcare infrastructure and technology, the demand for advanced diagnostic tools is rising. Increased access to healthcare services and a growing middle class are driving the need for effective diagnostic solutions, including ultrasound gastroscopes. This trend is expected to result in significant market expansion, as healthcare providers in these regions seek to improve patient care. The anticipated growth in emerging markets is likely to complement the overall market growth, contributing to the projected increase from 0.7 USD Billion in 2024 to 1.16 USD Billion by 2035.

Rising Incidence of Gastrointestinal Disorders

The prevalence of gastrointestinal disorders is on the rise globally, driving the demand for effective diagnostic tools. Conditions such as gastroesophageal reflux disease, peptic ulcers, and cancers of the digestive tract are becoming increasingly common. This trend necessitates the use of ultrasound gastroscopes, which provide non-invasive and accurate diagnostic options. The Global Ultrasound Gastroscopes Market Industry is responding to this growing need, as healthcare systems prioritize early detection and treatment of gastrointestinal issues. The increasing burden of these disorders is expected to contribute significantly to market growth, as healthcare providers seek to improve patient outcomes through advanced diagnostic technologies.