Market Analysis

In-depth Analysis of Ultrasound Gastroscopes Market Industry Landscape

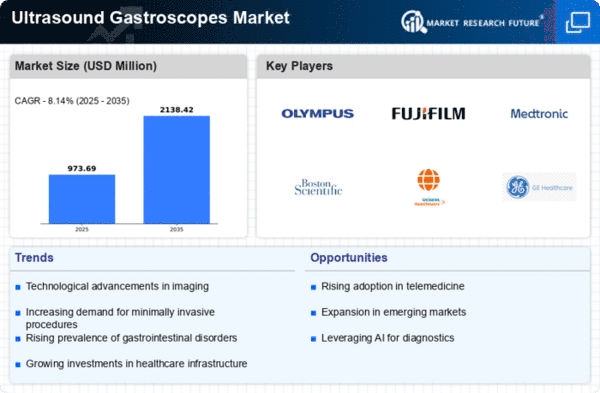

Continuous innovation remains a cornerstone of success in the ultrasound gastroscope market. To stay ahead of competitors in terms of market capture, companies must invest in R&D activities, keep up-to-date with technological advancements, and redesign their devices accordingly. These enhancements include advanced imaging techniques such as high-resolution ultrasound scanning, improved ergonomics, and better user interfaces, which lead to increased efficiency during diagnostics using ultrasound gastroscopes. Through these improvements, continuous improvement guarantees that businesses are able to provide health professionals with cutting-edge tools that will help them improve patient care. The market environment for ultrasound gastroscopes is dynamic due to several factors that influence its growth trajectory. Modern healthcare relies on specialized medical equipment used for diagnostic imaging of the gastrointestinal (GI) tract. The rising prevalence rates of GI disorders, together with the growing importance of early accurate diagnosis, drive demand for ultrasound gastroscopes. In fact, this kind of development changes the dynamics involved in this industry completely over time as they continue to be popular among key players in this field today and, even years from now, still maintain an upward trend towards more sales than ever before. Technological advances play a major role in shaping how the ultrasound gastroscopes market operates. Innovations within imaging technologies, such as high-frequency ultrasound and advanced image processing software, improve the clarity and accuracy of GI tract imaging. The advent of tiny, flexible gastroscopes fitted with ultrasound technology enhances patient comfort and diagnostic capabilities. This has led to diverse technological development in the medical field, which is crucial for it to remain competitive.

Leave a Comment