Rising Healthcare Expenditure

The increase in healthcare expenditure in the UK is a significant driver for the ultrasound gastroscopes market. With the government and private sectors investing more in healthcare infrastructure, there is a growing emphasis on acquiring advanced medical technologies. In 2025, healthcare spending is expected to reach £200 billion, reflecting a commitment to improving diagnostic and treatment capabilities. This financial support enables healthcare facilities to invest in state-of-the-art ultrasound gastroscopes, enhancing their diagnostic offerings. Consequently, the ultrasound gastroscopes market is likely to experience robust growth as facilities upgrade their equipment to meet rising patient demands and improve healthcare outcomes.

Growing Preference for Outpatient Procedures

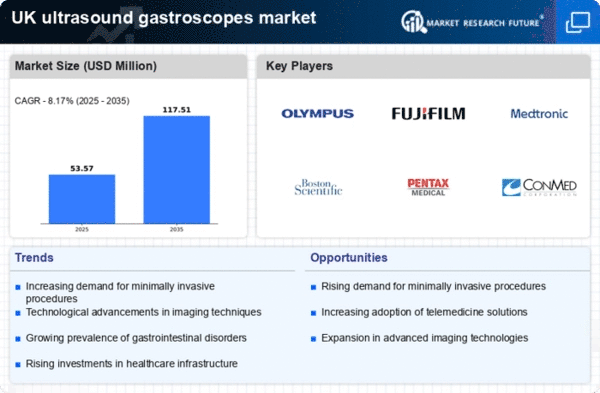

The shift towards outpatient procedures is a notable trend impacting the ultrasound gastroscopes market. Patients and healthcare providers alike are increasingly favouring minimally invasive techniques that allow for quicker recovery times and reduced hospital stays. This preference aligns with the broader movement towards outpatient care, which is projected to grow by 20% in the next five years in the UK. As ultrasound gastroscopes facilitate such procedures, their demand is likely to rise. The ultrasound gastroscopes market is thus poised to expand, as healthcare systems adapt to meet the needs of patients seeking efficient and less invasive diagnostic options.

Technological Innovations in Imaging Techniques

Technological advancements in imaging techniques are significantly influencing the ultrasound gastroscopes market. Innovations such as high-resolution imaging, real-time visualization, and enhanced image processing capabilities are making ultrasound gastroscopes more effective and user-friendly. These advancements not only improve diagnostic accuracy but also reduce the time required for procedures, which is crucial in a busy healthcare environment. The market is witnessing a shift towards devices that integrate artificial intelligence and machine learning, further enhancing diagnostic capabilities. As a result, healthcare facilities in the UK are increasingly investing in these advanced ultrasound gastroscopes, which are expected to capture a larger market share in the coming years.

Increasing Prevalence of Gastrointestinal Disorders

The rising incidence of gastrointestinal disorders in the UK is a primary driver for the ultrasound gastroscopes market. Conditions such as gastroesophageal reflux disease (GERD), peptic ulcers, and inflammatory bowel disease are becoming more common, necessitating advanced diagnostic tools. According to recent health statistics, approximately 30% of the UK population experiences some form of gastrointestinal issue, leading to a heightened demand for effective diagnostic solutions. This trend is likely to propel the adoption of ultrasound gastroscopes, as they offer non-invasive and accurate imaging capabilities. The ultrasound gastroscopes market is thus positioned to benefit from this growing patient population, as healthcare providers seek to enhance diagnostic accuracy and improve patient outcomes.

Enhanced Training and Education for Healthcare Professionals

The emphasis on training and education for healthcare professionals is a crucial factor driving the ultrasound gastroscopes market. As the complexity of medical technologies increases, there is a corresponding need for comprehensive training programs that equip practitioners with the necessary skills to operate advanced ultrasound gastroscopes effectively. Initiatives by medical institutions and professional bodies in the UK are focusing on enhancing the skill sets of healthcare providers, which is expected to lead to improved adoption rates of these devices. The ultrasound gastroscopes market stands to benefit from this trend, as better-trained professionals are likely to utilize these technologies more effectively, ultimately improving patient care.