Favorable Reimbursement Policies

Favorable reimbursement policies for diagnostic procedures are playing a significant role in shaping the ultrasound gastroscopes market. Insurance coverage for ultrasound gastroscopy procedures is becoming more comprehensive, encouraging healthcare providers to adopt these technologies. As reimbursement rates improve, hospitals and clinics are more likely to invest in ultrasound gastroscopes, knowing that they will receive adequate compensation for their use. This trend is likely to stimulate growth in the ultrasound gastroscopes market, as financial incentives drive the adoption of advanced diagnostic tools, ultimately benefiting patient care and outcomes.

Expansion of Healthcare Infrastructure

The expansion of healthcare infrastructure in the US is a crucial driver for the ultrasound gastroscopes market. With the establishment of new hospitals, outpatient clinics, and diagnostic centers, there is a growing need for advanced medical equipment, including ultrasound gastroscopes. This expansion is particularly evident in underserved areas, where access to quality healthcare is improving. As facilities upgrade their diagnostic capabilities, the demand for ultrasound gastroscopes is expected to rise. The ultrasound gastroscopes market stands to benefit from this trend, as healthcare providers invest in state-of-the-art technology to enhance patient care and streamline diagnostic processes.

Growing Awareness of Preventive Healthcare

There is a notable increase in awareness regarding preventive healthcare among the US population, which is positively impacting the ultrasound gastroscopes market. Patients are becoming more proactive about their health, seeking regular screenings and diagnostic procedures to catch potential issues early. This trend is supported by healthcare campaigns promoting the importance of early detection of gastrointestinal diseases. As a result, healthcare providers are expanding their offerings to include advanced diagnostic tools like ultrasound gastroscopes. The ultrasound gastroscopes market is thus likely to see a surge in demand as more individuals opt for preventive measures, leading to increased utilization of these devices.

Technological Innovations in Imaging Techniques

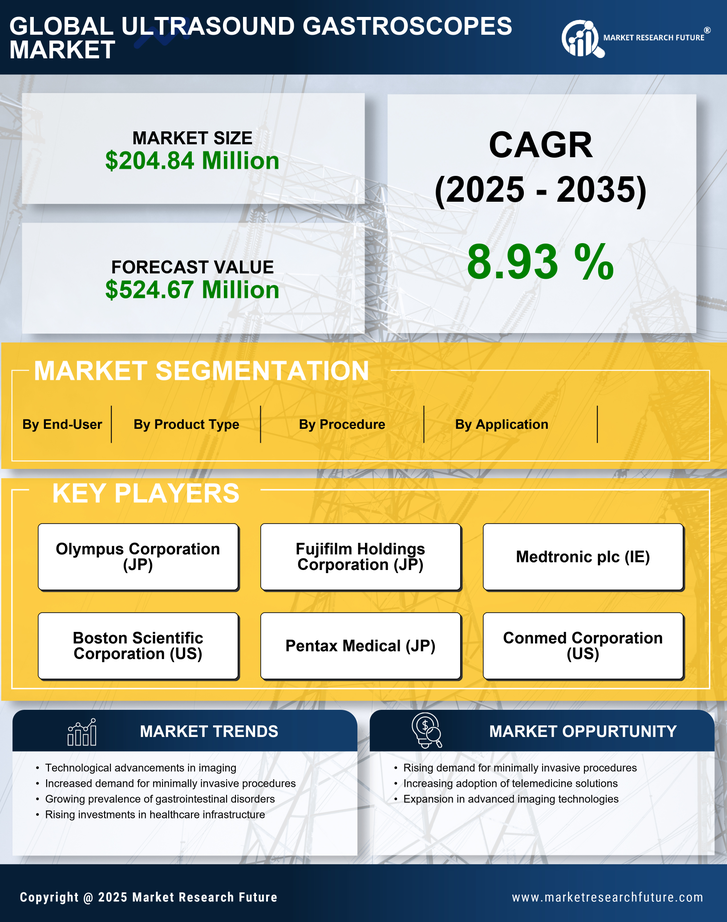

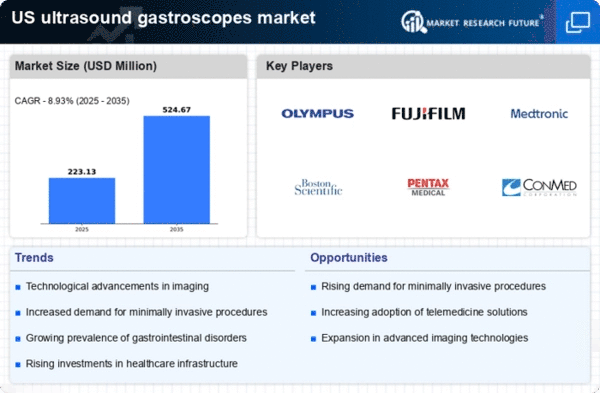

Technological advancements in imaging techniques are significantly influencing the ultrasound gastroscopes market. Innovations such as high-resolution imaging, real-time visualization, and improved probe designs are enhancing the capabilities of ultrasound gastroscopes. These advancements allow for more accurate diagnoses and less invasive procedures, which are increasingly preferred by both patients and healthcare providers. The market is witnessing a shift towards devices that integrate artificial intelligence and machine learning, potentially improving diagnostic efficiency. As a result, the ultrasound gastroscopes market is likely to experience growth driven by the adoption of these cutting-edge technologies, which promise to revolutionize gastrointestinal diagnostics.

Increasing Prevalence of Gastrointestinal Disorders

The rising incidence of gastrointestinal disorders in the US is a primary driver for the ultrasound gastroscopes market. Conditions such as gastroesophageal reflux disease (GERD), peptic ulcers, and inflammatory bowel disease are becoming more common, necessitating advanced diagnostic tools. According to recent health statistics, approximately 60 million Americans experience GERD symptoms monthly, highlighting the need for effective diagnostic solutions. This growing patient population is likely to increase the demand for ultrasound gastroscopes, as healthcare providers seek to enhance diagnostic accuracy and patient outcomes. The ultrasound gastroscopes market is thus positioned to benefit from this trend, as more healthcare facilities invest in advanced imaging technologies to address the rising burden of gastrointestinal diseases.