Government Initiatives and Funding

Government initiatives aimed at improving sleep health are playing a crucial role in the growth of the sleep apnea-devices market. The UK government has been increasingly focusing on public health campaigns that promote awareness of sleep disorders and their associated risks. Funding for research and development in sleep medicine is also on the rise, which may lead to the introduction of new devices and treatment options. Additionally, healthcare policies that support the reimbursement of sleep apnea devices are likely to encourage more patients to seek treatment. This supportive regulatory environment is expected to foster innovation and accessibility within the sleep apnea-devices market.

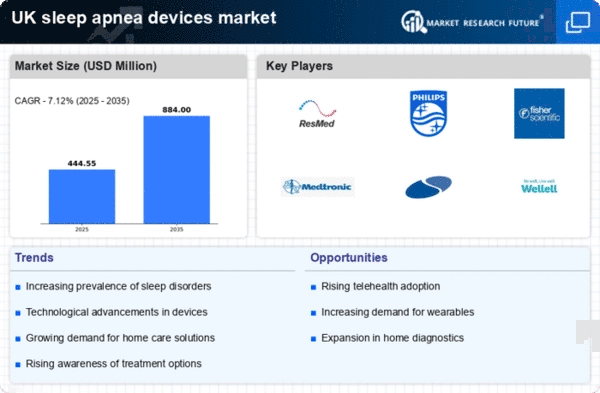

Rising Prevalence of Sleep Disorders

The increasing incidence of sleep disorders, particularly sleep apnea, is a primary driver for the sleep apnea-devices market. Recent studies indicate that approximately 4.7 million adults in the UK are affected by sleep apnea, leading to heightened demand for effective treatment solutions. This growing prevalence is prompting healthcare providers to recommend diagnostic and therapeutic devices more frequently. As awareness of the health risks associated with untreated sleep apnea, such as cardiovascular diseases and diabetes, continues to rise, the market is likely to experience significant growth. Thus, the market is positioned to expand as more individuals seek diagnosis and treatment options, contributing to a robust healthcare ecosystem.

Aging Population and Healthcare Demand

The aging population in the UK is contributing to an increased demand for healthcare services, including those related to sleep apnea. As individuals age, the likelihood of developing sleep disorders rises, which in turn drives the need for effective treatment devices. The sleep apnea-devices market is likely to benefit from this demographic shift, as older adults are more prone to conditions that exacerbate sleep apnea, such as obesity and cardiovascular issues. Consequently, healthcare providers are expected to prioritize the diagnosis and treatment of sleep apnea in this demographic, further propelling market growth. The intersection of an aging population and rising healthcare demand presents a significant opportunity for stakeholders in the sleep apnea-devices market.

Increased Focus on Preventive Healthcare

There is a growing emphasis on preventive healthcare in the UK, which is influencing the sleep apnea-devices market. As healthcare systems shift towards proactive management of health conditions, the importance of early diagnosis and treatment of sleep apnea is becoming more pronounced. This trend is encouraging individuals to seek out diagnostic devices and treatment options before complications arise. The sleep apnea-devices market is likely to see an uptick in demand as more people recognize the benefits of addressing sleep disorders early. This proactive approach not only improves patient outcomes but also reduces long-term healthcare costs, making it a compelling driver for market growth.

Technological Innovations in Treatment Devices

Technological advancements in the design and functionality of sleep apnea devices are significantly influencing the sleep apnea-devices market. Innovations such as portable CPAP machines, automatic titration devices, and integrated mobile applications for monitoring sleep patterns are enhancing patient compliance and comfort. The introduction of smart technology, which allows for real-time data tracking and personalized treatment plans, is particularly appealing to consumers. As these devices become more user-friendly and effective, they are likely to attract a broader customer base. The market is projected to grow as manufacturers invest in research and development to create cutting-edge solutions that cater to the evolving needs of patients.