Rising Healthcare Expenditure

Rising healthcare expenditure in South Korea is another critical driver for the sleep apnea-devices market. With the government and private sectors investing more in healthcare services, patients are increasingly able to access advanced medical technologies. The healthcare expenditure in South Korea has seen a steady increase, reaching approximately 8.1% of GDP in recent years. This financial commitment facilitates better access to diagnostic tools and treatment options for sleep apnea, including various devices. As healthcare systems continue to evolve and improve, the market for sleep apnea devices is likely to expand, driven by increased availability and affordability of these essential products.

Aging Population and Health Concerns

The aging population in South Korea is a significant driver for the sleep apnea-devices market. As individuals age, the likelihood of developing sleep apnea increases, with studies indicating that nearly 50% of older adults may experience some form of sleep-disordered breathing. This demographic shift is prompting healthcare providers to prioritize sleep health, leading to more screenings and diagnoses. The demand for sleep apnea devices is expected to rise in tandem with the aging population, as older adults seek effective solutions to improve their quality of life. This trend underscores the importance of targeted marketing strategies aimed at older consumers, which could further stimulate market growth.

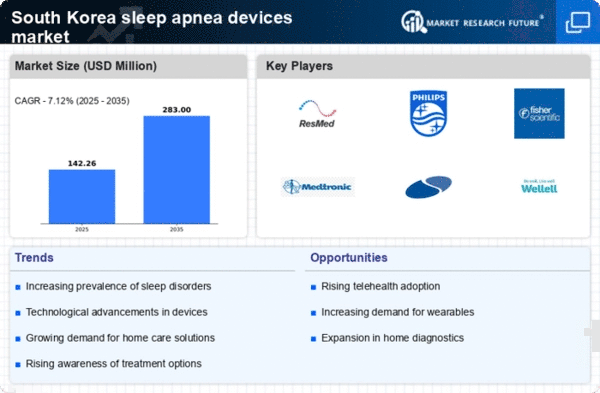

Increasing Awareness of Sleep Disorders

The growing awareness of sleep disorders among the South Korean population is a pivotal driver for the sleep apnea-devices market. Educational campaigns and health initiatives have highlighted the importance of diagnosing and treating sleep apnea, leading to increased consultations with healthcare professionals. This heightened awareness is reflected in the rising number of sleep studies conducted, which have surged by approximately 30% over the past few years. As more individuals recognize the symptoms of sleep apnea, the demand for effective treatment options, including CPAP machines and oral appliances, is likely to escalate. Consequently, this trend is expected to significantly boost the market, as patients seek reliable devices to manage their condition.

Technological Innovations in Device Design

Technological innovations play a crucial role in shaping the sleep apnea-devices market. Recent advancements in device design, such as the development of portable and user-friendly CPAP machines, have made treatment more accessible and appealing to patients. Features like noise reduction, improved comfort, and connectivity with mobile applications for monitoring sleep patterns are becoming standard. In South Korea, the introduction of smart devices that integrate with health tracking systems has the potential to enhance patient compliance and satisfaction. As these innovations continue to evolve, they are likely to attract a broader consumer base, thereby driving market growth and increasing competition among manufacturers.

Integration of Telemedicine in Sleep Health

The integration of telemedicine into sleep health management is emerging as a transformative driver for the sleep apnea-devices market. Telehealth services allow patients to consult with specialists remotely, making it easier to receive diagnoses and treatment recommendations. In South Korea, the adoption of telemedicine has accelerated, particularly in the wake of advancements in digital health technologies. This shift not only enhances patient access to care but also encourages timely interventions for sleep apnea. As telemedicine continues to gain traction, it is expected to create new opportunities for the sleep apnea-devices market, as patients seek devices that can be monitored and adjusted remotely.