Innovations in Product Formulation

Innovations in product formulation are significantly influencing the nutricosmetics Market. Manufacturers are increasingly investing in research and development to create advanced formulations that combine efficacy with appealing sensory attributes. This includes the use of novel delivery systems, such as liposomal technology, which enhances the bioavailability of active ingredients. In the UK, the introduction of innovative products, such as collagen peptides and botanical extracts, has led to a surge in consumer interest. The nutricosmetics Market is expected to witness a notable increase in sales, with estimates suggesting a rise to £500 million by 2027, as consumers gravitate towards products that promise visible results and improved skin health.

Rising Demand for Clean Label Products

The rising demand for clean label products is reshaping the nutricosmetics Market. Consumers are increasingly scrutinizing ingredient lists and seeking transparency in product formulations. This trend is particularly pronounced in the UK, where a significant portion of the population prefers products that are free from artificial additives and preservatives. As a result, brands are reformulating their offerings to align with these consumer preferences, often highlighting natural and organic ingredients. This shift not only enhances brand loyalty but also attracts new customers who prioritize clean beauty. The nutricosmetics Market is likely to benefit from this trend, with projections indicating that clean label products could account for over 30% of total sales by 2028.

Influence of Social Media and Digital Marketing

The influence of social media and digital marketing is a crucial driver for the nutricosmetics Market. Platforms such as Instagram and TikTok have become vital channels for brands to engage with consumers, showcasing product benefits and user testimonials. This digital presence allows for targeted marketing strategies that resonate with younger demographics, who are more inclined to purchase products endorsed by influencers. In the UK, the nutricosmetics Market is experiencing a transformation as brands leverage social media to create buzz around new launches and educate consumers about the benefits of nutricosmetics. This trend is expected to propel market growth, with online sales projected to increase by 25% over the next five years.

Increasing Consumer Awareness of Health Benefits

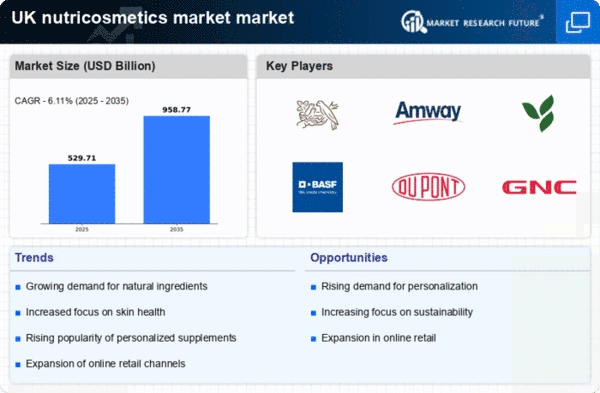

The growing awareness among consumers regarding the health benefits of nutricosmetics is a pivotal driver for the nutricosmetics Market. As individuals become more health-conscious, they are increasingly seeking products that not only enhance beauty but also promote overall wellness. This trend is reflected in the rising demand for supplements that support skin health, hair vitality, and nail strength. In the UK, the nutricosmetics Market is projected to grow at a CAGR of approximately 8% from 2025 to 2030, driven by this heightened consumer awareness. The integration of vitamins, minerals, and antioxidants in nutricosmetic formulations is appealing to a demographic that prioritizes holistic health, thereby expanding the market's reach and potential.

Aging Population and Demand for Anti-Aging Solutions

The aging population in the UK is driving demand for anti-aging solutions within the nutricosmetics Market. As the demographic landscape shifts, there is a growing emphasis on products that address age-related concerns such as skin elasticity, hydration, and overall appearance. This trend is particularly relevant as individuals seek proactive measures to maintain their youthful appearance. The nutricosmetics Market is likely to see a surge in products targeting this demographic, with estimates suggesting that anti-aging formulations could represent over 40% of total market sales by 2026. This focus on aging gracefully is prompting brands to innovate and expand their product lines to cater to the needs of older consumers.