Government Investment in Emergency Services

The UK government has been actively investing in the Emergency Medical Services Products Market, recognizing the critical role of emergency services in public health. Recent initiatives have included funding for new ambulances equipped with state-of-the-art medical technology. In 2025, the government allocated an additional £50 million to enhance emergency response capabilities across various regions. This investment not only aims to improve the quality of care provided but also to ensure that emergency services are adequately equipped to handle increasing patient volumes. Such financial support is likely to stimulate growth within the market, encouraging innovation and the adoption of new medical products.

Increasing Demand for Advanced Medical Equipment

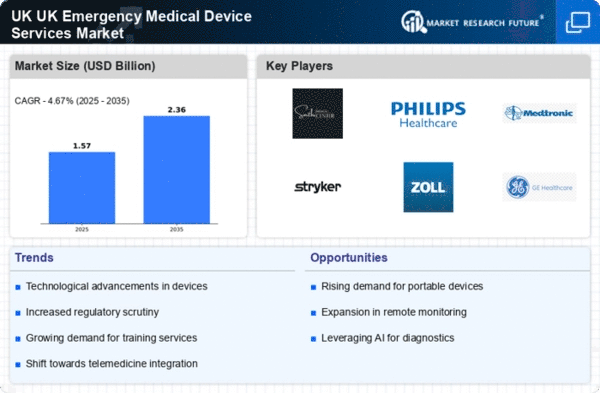

The UK Emergency Medical Services Products Market is experiencing a notable surge in demand for advanced medical equipment. This trend is largely driven by the increasing complexity of medical emergencies and the need for rapid response capabilities. For instance, the introduction of portable ultrasound devices and advanced cardiac monitors has transformed pre-hospital care. According to recent data, the market for emergency medical equipment in the UK is projected to grow at a compound annual growth rate (CAGR) of approximately 5.2% over the next five years. This growth is indicative of the healthcare sector's commitment to enhancing patient outcomes through innovative technologies, thereby reinforcing the importance of advanced medical equipment in emergency services.

Integration of Telemedicine in Emergency Services

The integration of telemedicine into the UK Emergency Medical Services Products Market is reshaping how emergency care is delivered. Telemedicine allows for real-time consultations between paramedics and hospital specialists, facilitating quicker decision-making in critical situations. This approach has been shown to improve patient outcomes and reduce hospital admission rates. As of January 2026, approximately 30% of ambulance services in the UK have adopted telemedicine solutions, reflecting a growing trend towards remote healthcare delivery. The potential for telemedicine to enhance the efficiency of emergency services is significant, suggesting a transformative impact on the market.

Rising Public Awareness of Emergency Medical Services

There is a growing public awareness regarding the importance of emergency medical services in the UK, which is positively influencing the Emergency Medical Services Products Market. Campaigns aimed at educating the public about the role of emergency services have led to increased utilization of these services. This heightened awareness has also resulted in greater demand for high-quality medical products that can be deployed in emergencies. As more individuals recognize the value of timely and effective emergency care, the market is expected to expand, with manufacturers responding by developing more advanced and user-friendly medical equipment.

Focus on Training and Education for Emergency Personnel

The emphasis on training and education for emergency personnel is a crucial driver in the UK Emergency Medical Services Products Market. Enhanced training programs ensure that paramedics and emergency responders are well-equipped to utilize advanced medical technologies effectively. In recent years, various organizations have developed comprehensive training modules that incorporate the latest medical equipment and protocols. This focus on education is essential, as it directly correlates with improved patient care and outcomes. As the market evolves, the need for continuous professional development in emergency services will likely drive demand for innovative training solutions and products.