Growing Demand for Real-Time Data

The demand for real-time data in various sectors is propelling the digital inspection market forward. Industries are increasingly relying on immediate insights to make informed decisions, particularly in sectors like energy, utilities, and transportation. The ability to conduct inspections and receive instant feedback can lead to enhanced operational efficiency and reduced downtime. In the UK, the market is projected to expand by 20% as organizations prioritize real-time data capabilities. This shift towards data-driven decision-making is likely to foster innovation within the digital inspection market, encouraging the development of more sophisticated inspection technologies.

Regulatory Compliance and Standards

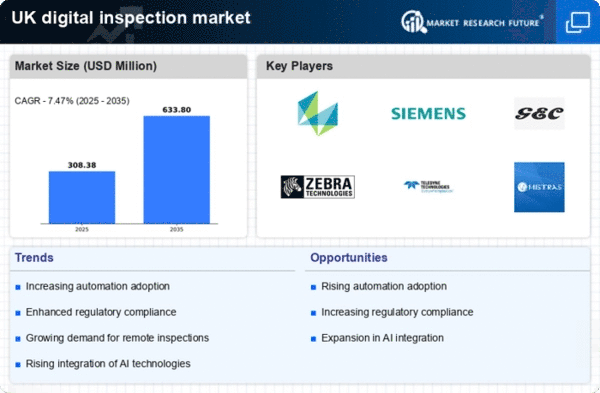

The digital inspection market is significantly influenced by the stringent regulatory compliance and standards set forth by UK authorities. Industries such as construction and manufacturing are required to adhere to specific safety and quality regulations, which necessitate regular inspections. The market is expected to grow as companies invest in digital inspection solutions to ensure compliance with these regulations. In 2025, it is estimated that compliance-related expenditures will account for nearly 15% of the total market value. This trend indicates that businesses are increasingly recognizing the importance of digital inspection technologies in maintaining compliance and avoiding costly penalties.

Increased Investment in Infrastructure

The digital inspection market is benefiting from the increased investment in infrastructure projects across the UK. Government initiatives aimed at upgrading transportation networks, utilities, and public facilities are driving the demand for efficient inspection solutions. It is anticipated that infrastructure spending will reach £100 billion by 2027, creating a substantial opportunity for digital inspection technologies. As these projects require rigorous inspection processes to ensure safety and quality, the digital inspection market is poised for growth. This influx of investment is likely to stimulate advancements in inspection methodologies, further enhancing the market's potential.

Rising Awareness of Sustainability Practices

The digital inspection market is increasingly influenced by the rising awareness of sustainability practices among businesses. Companies are now more focused on minimizing their environmental impact and ensuring sustainable operations. Digital inspection technologies facilitate this by enabling more efficient resource management and waste reduction. In the UK, the market is expected to grow by 18% as organizations adopt these technologies to align with sustainability goals. This trend suggests that the digital inspection market is not only a tool for compliance but also a means to promote environmentally responsible practices within various industries.

Technological Advancements in Inspection Tools

The digital inspection market is experiencing a surge due to rapid technological advancements in inspection tools. Innovations such as drones, 3D scanning, and advanced imaging technologies are enhancing the efficiency and accuracy of inspections. In the UK, the adoption of these technologies is projected to increase by approximately 25% over the next five years. This growth is driven by the need for precise data collection and analysis, which is crucial for industries such as construction, manufacturing, and infrastructure. As companies seek to improve operational efficiency and reduce costs, the digital inspection market is likely to benefit from these advancements, leading to a more competitive landscape.