Increasing Vehicle Production

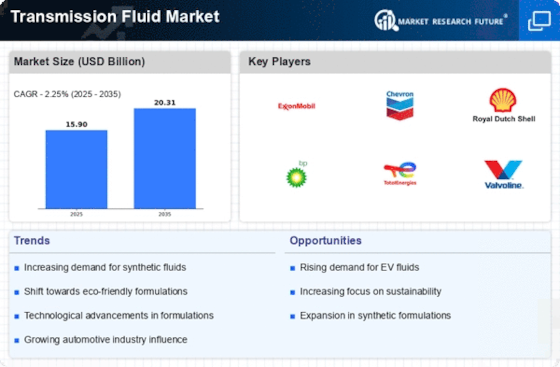

The Transmission Fluid Market is experiencing growth due to the rising production of vehicles across various segments. As manufacturers ramp up production to meet consumer demand, the need for high-quality transmission fluids becomes paramount. In 2025, the automotive sector is projected to produce over 90 million vehicles, which directly correlates with the demand for transmission fluids. This increase in vehicle production not only drives the need for conventional fluids but also for advanced synthetic options that enhance performance and longevity. Consequently, the Transmission Fluid Market is likely to see a surge in sales as automakers prioritize the use of superior fluids to ensure optimal vehicle performance and compliance with stringent regulations.

Consumer Awareness and Education

Consumer awareness regarding the importance of transmission fluid maintenance is increasingly influencing the Transmission Fluid Market. As vehicle owners become more informed about the role of transmission fluids in vehicle performance and longevity, they are more likely to invest in high-quality products. Educational campaigns and resources provided by manufacturers and automotive service providers are contributing to this trend. In 2025, it is expected that consumer spending on premium transmission fluids will rise by 20%, as individuals seek to enhance their vehicle's performance. This growing awareness not only drives demand but also encourages manufacturers to focus on quality and innovation within the Transmission Fluid Market.

Growth of Electric and Hybrid Vehicles

The rise of electric and hybrid vehicles is poised to transform the Transmission Fluid Market. Although these vehicles utilize different transmission systems, the demand for specialized fluids remains critical. As the market for electric and hybrid vehicles expands, manufacturers are developing transmission fluids tailored to the unique requirements of these systems. In 2025, it is projected that the market for transmission fluids in electric and hybrid vehicles will grow by 15%, reflecting the industry's adaptation to changing automotive technologies. This evolution not only presents challenges but also opportunities for growth within the Transmission Fluid Market, as companies innovate to meet the needs of this emerging segment.

Technological Advancements in Fluid Formulation

Innovations in fluid formulation are significantly impacting the Transmission Fluid Market. The development of advanced synthetic fluids, which offer superior thermal stability and improved lubrication properties, is becoming increasingly prevalent. These advancements are driven by the need for enhanced performance in modern vehicles, particularly those equipped with automatic transmissions. In 2025, it is estimated that synthetic fluids will account for over 60% of the market share, reflecting a shift towards higher-quality products. This trend not only improves vehicle efficiency but also extends the lifespan of transmission systems, thereby influencing consumer preferences and driving growth within the Transmission Fluid Market.

Regulatory Compliance and Environmental Standards

The Transmission Fluid Market is also shaped by stringent regulatory compliance and environmental standards. Governments worldwide are implementing regulations aimed at reducing emissions and promoting eco-friendly products. As a result, manufacturers are compelled to develop transmission fluids that meet these evolving standards. In 2025, it is anticipated that the demand for environmentally friendly transmission fluids will increase by approximately 25%, as consumers and manufacturers alike prioritize sustainability. This shift not only influences product development but also enhances the competitive landscape within the Transmission Fluid Market, as companies strive to innovate and comply with regulations while meeting consumer expectations.