Research Methodology on Wireless Power Transmission Market

Introduction

Wireless power transmission (WPT) has revolutionized the way energy is transmitted across the globe. It is based on the principle of transferring energy with radio frequency signals. This process has revolutionized the way energy is consumed and how it is stored. WPT offers solutions that are suitable for alternative energy sources such as solar, wind, and hydropower. It is a major breakthrough in alternative energy resource utilization and utilization by limiting transmission losses. For example, wireless power transmission can minimize transmission losses between cells and storage devices in large-scale distributed energy storage systems.

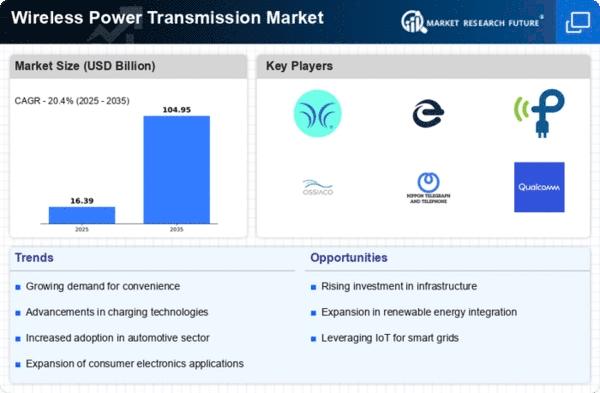

The Global Wireless Power Transmission Market is prominently driven by the growing renewable energy resource utilization, the rising need for uninterrupted power grid solutions, advancements in communication technologies, and the capability to reduce energy losses in the field of power transmission. In addition, the rising usage of mobile and stationary devices in various industries is anticipated to rising the number of applications that require WPT solutions. For instance, the development of solutions suitable for long-distance applications, such as in the transmission of solar or wind power, is expected to drive the demand.

Hence, the Global Wireless Power Transmission Market is projected to have a strong compounded annual growth rate of 14.5% throughout the forecast period 2023 to 2030.

Research Aim

The general aim of the research is to understand the drivers, restraints, and trends affecting the Global Wireless Power Transmission Market.

Research Objectives

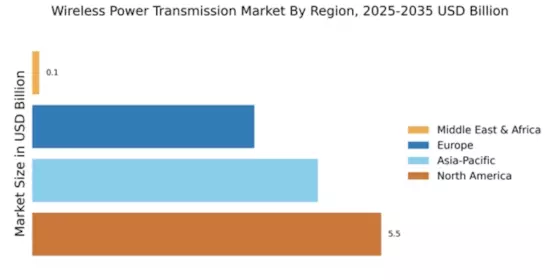

- To analyze and study the Global Wireless Power Transmission Market size by technology, application and region.

- To study the market value and segment forecasts for different regions.

- To analyze and study different types of technology used in WPT.

- To analyze and understand the impact of different driving and restraining factors on the Global Wireless Power Transmission Market.

- To detect opportunities, challenges and Porter’s Five Forces analysis of the Global Wireless Power Transmission Market.

Research Methodology

This report is based on an in-depth analysis of the Global Wireless Power Transmission Market. To gain a deeper insight into the dynamics of the market, a mix of primary and secondary research has been used. The market size is estimated by interfacing with industry experts and an extensive quantitative analysis of historical and forecast data. Secondary research studies have been conducted through sources such as press releases, company websites, paid databases, and publications. Primary research has been conducted through surveys, interviews, and various discussions conducted with industry experts and professionals.

Secondary Research

Secondary research involves extensively scanning through periodicals, journals, books, databases, websites, and other publicly available documents to gain insights into the Global Wireless Power Transmission Market. Sources crucial to our secondary research include company websites, annual reports, financial reports, broker reports, investor briefings, Conference Proceedings, SEC filings, and internal and external proprietary databases. Once the secondary research is completed, the collected information is gathered to define and scope the research objectives. The scope of the study is narrowed down to regions, application areas, and types of technology used in WPT.

Primary Research

The primary research is conducted to obtain market value for the marketplace as a whole. To gain comprehensive insights into the market, detailed primary interviews were conducted with respondents such as industry experts, executives, decision-makers, and C-level executives from the key market players. In addition to primary research, a comprehensive analysis of the secondary research was conducted. Both qualitative and quantitative analysis of the research data was used to come up with the research report.

Market Structure

The Market Structure analysis provides a detailed analysis of the Global Wireless Power Transmission Market. The segmentation of the market is done based on technology, application, and region. This segmentation provides better insights into the dynamics of the Global Wireless Power Transmission Market.

Data Mining

Data mining is used to come up with factors that affect the Global Wireless Power Transmission Market. The data mining process involves the analysis of various macro and microeconomic conditions and their impact on the Global Wireless Power Transmission Market. This process is done with the help of market surveys and surveys of industry experts about the Global Wireless Power Transmission Market.

Data Analysis

The data gathered from the primary and secondary research was analyzed by using the triangulation method. This method involves using the closed-loop research process, wherein the primary and secondary research data are merged to come up with decisive data. Then the qualitative and quantitative data gathered from the primary and secondary sources is analyzed to gain insight into the market.

The analysis of the data is done by using Porter’s Five Forces Model, SWOT Analysis, market attractiveness analysis and market growth opportunity analysis. All these techniques are used to analyze the data and to come up with final results regarding the drivers, restraints, and opportunities affecting the Global Wireless Power Transmission Market.

Results

The Global Wireless Power Transmission Market is expected to grow at a staggering CAGR during the forecast period 2023 to 2030 owing to the factors driving the market. These include rising demand for uninterrupted power grid solutions, advancements in communication technologies, the capability to reduce energy losses in the field of power transmission, and the increasing usage of mobile and stationary devices. The key restraining factor for the market is the lack of standardization.

Conclusion

This report provides an in-depth analysis of the Global Wireless Power Transmission Market. The research is conducted by using primary and secondary research techniques. The data gathered through primary and secondary research was analyzed by using the triangulation method. The drivers, restraints, and trends of the Global Wireless Power Transmission Market have been identified based on the data analysis. This report provides a comprehensive understanding of the Global Wireless Power Transmission Market.