Increasing Regulatory Standards

The Titanium Dioxide Market is significantly impacted by increasing regulatory standards concerning environmental and health safety. Governments worldwide are implementing stricter regulations on the use of chemicals, including titanium dioxide, particularly in consumer products. This trend is likely to shape the market dynamics, as manufacturers must adapt to comply with these regulations. In 2025, it is anticipated that compliance costs may rise, influencing pricing strategies within the Titanium Dioxide Market. However, this could also lead to innovations in safer alternatives and improved product formulations, ultimately benefiting consumers and the environment.

Growth in Construction Activities

The Titanium Dioxide Market is poised for growth due to the ongoing expansion in construction activities. As urbanization accelerates, the demand for construction materials that incorporate titanium dioxide is likely to increase. In 2025, the construction sector is projected to account for approximately 15% of the total titanium dioxide market. This growth is attributed to the use of titanium dioxide in cement and concrete products, where it enhances durability and provides UV protection. Additionally, the rising trend of sustainable building practices may further drive the Titanium Dioxide Market, as builders seek materials that contribute to energy efficiency and longevity.

Expansion in Plastics and Polymers

The Titanium Dioxide Market is significantly influenced by the expansion of the plastics and polymers sector. As industries increasingly utilize titanium dioxide as a white pigment and opacifier, the demand for this mineral is expected to rise. In 2025, the plastics segment is anticipated to represent around 25% of the overall titanium dioxide consumption. This trend is fueled by the growing production of consumer goods, packaging materials, and automotive components, where titanium dioxide enhances product quality and visual appeal. Furthermore, the shift towards lightweight materials in various applications may bolster the Titanium Dioxide Market, as manufacturers seek to improve efficiency and reduce costs.

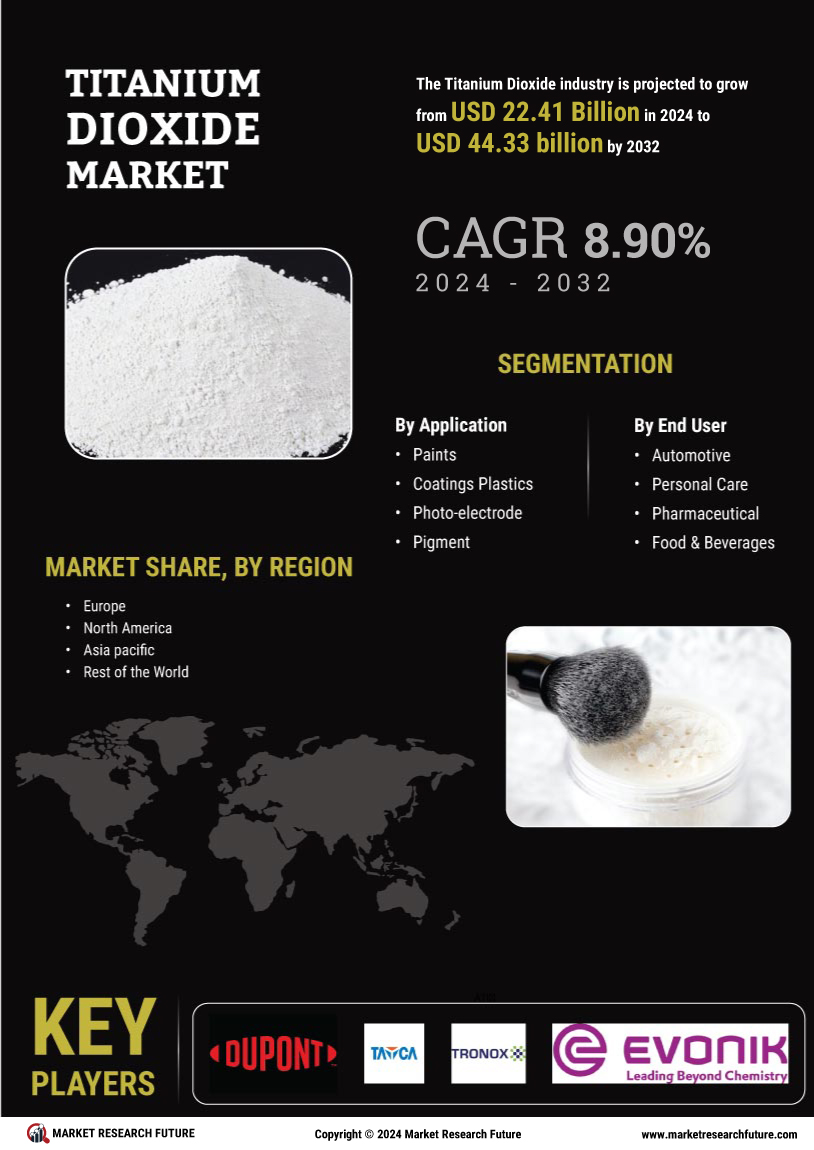

Rising Demand in Paints and Coatings

The Titanium Dioxide Market is experiencing a notable surge in demand, particularly within the paints and coatings sector. This growth is primarily driven by the increasing need for high-performance coatings that offer durability and aesthetic appeal. In 2025, the paints and coatings segment is projected to account for approximately 50% of the total demand for titanium dioxide, reflecting a robust market trend. The shift towards eco-friendly and sustainable products further amplifies this demand, as manufacturers seek to comply with stringent environmental regulations. Consequently, the Titanium Dioxide Market is likely to witness innovations in formulations that enhance performance while minimizing environmental impact.

Technological Innovations in Production

The Titanium Dioxide Market is benefiting from technological innovations in production processes. Advances in manufacturing techniques are enabling the production of higher-quality titanium dioxide with improved properties. These innovations not only enhance the efficiency of production but also reduce costs, making titanium dioxide more accessible to various industries. In 2025, it is expected that the introduction of new technologies will lead to a 10% increase in production capacity, thereby meeting the rising demand across sectors such as paints, plastics, and construction. Consequently, the Titanium Dioxide Market is likely to experience a shift towards more sustainable and cost-effective production methods.