Technological Innovations

Technological advancements in the development of tissue sealants and adhesives are reshaping the Tissue Sealants and Tissue Adhesives Market. Innovations such as bioengineered materials and smart adhesives that respond to environmental stimuli are emerging. These advancements not only enhance the efficacy of sealants but also expand their applications in various surgical procedures. The introduction of products that offer better biocompatibility and faster setting times is likely to attract more healthcare providers. As a result, the Tissue Sealants and Tissue Adhesives Market is expected to experience growth driven by these cutting-edge technologies, which may lead to improved patient outcomes and satisfaction.

Rising Surgical Procedures

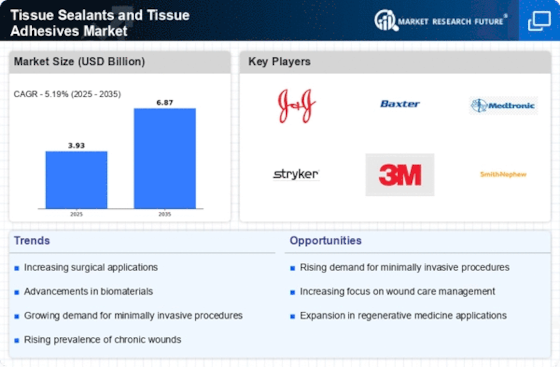

The increasing number of surgical procedures across various medical specialties appears to be a primary driver for the Tissue Sealants and Tissue Adhesives Market. As surgical techniques evolve, the demand for effective and reliable tissue sealants and adhesives rises. For instance, the American College of Surgeons reported a steady increase in surgical operations, with millions performed annually. This trend suggests that healthcare providers are increasingly adopting advanced materials to enhance patient outcomes and reduce recovery times. The Tissue Sealants and Tissue Adhesives Market is likely to benefit from this surge, as these products are essential in minimizing complications and improving surgical efficiency.

Growing Demand for Wound Care

The escalating need for advanced wound care solutions is significantly influencing the Tissue Sealants and Tissue Adhesives Market. With an increasing prevalence of chronic wounds, such as diabetic ulcers and pressure sores, healthcare systems are seeking innovative products that promote faster healing. According to recent data, the wound care market is projected to grow substantially, driven by the aging population and rising incidences of lifestyle-related diseases. Tissue sealants and adhesives play a crucial role in wound management, offering advantages such as reduced infection rates and improved healing times. This growing demand is likely to propel the Tissue Sealants and Tissue Adhesives Market forward.

Regulatory Support and Approvals

Regulatory support and streamlined approval processes for new tissue sealants and adhesives are contributing positively to the Tissue Sealants and Tissue Adhesives Market. Regulatory bodies are increasingly recognizing the importance of these products in enhancing surgical outcomes and patient safety. The expedited approval of innovative sealants and adhesives is likely to encourage manufacturers to invest in research and development. This trend may lead to a wider array of products entering the market, thus expanding the options available to healthcare providers. Consequently, the Tissue Sealants and Tissue Adhesives Market is poised for growth as regulatory frameworks evolve to support innovation.

Increased Awareness and Acceptance

The rising awareness among healthcare professionals and patients regarding the benefits of tissue sealants and adhesives is a notable driver for the Tissue Sealants and Tissue Adhesives Market. Educational initiatives and training programs are enhancing the understanding of these products' advantages, such as reduced surgical time and lower complication rates. As more practitioners recognize the efficacy of these materials, their adoption in clinical settings is likely to increase. This growing acceptance may lead to a broader market penetration of tissue sealants and adhesives, thereby fostering growth within the Tissue Sealants and Tissue Adhesives Market.