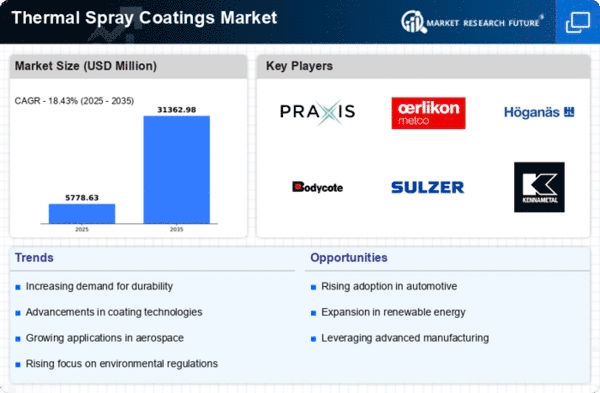

Market Growth Projections

The Global Thermal Spray Coatings Market Industry is poised for substantial growth, with is projected to grow from USD 5778.6 Million in 2025 to USD 31362.98 Million by 2035, exhibiting a compound annual growth rate (CAGR) of 18.43%, reflecting the increasing adoption of thermal spray coatings across various industries. The market's expansion is driven by factors such as technological advancements, regulatory support, and the growing demand for energy-efficient solutions. As industries continue to seek innovative ways to enhance performance and sustainability, the thermal spray coatings market is likely to thrive.

Growing Focus on Energy Efficiency

The Global Thermal Spray Coatings Market Industry is significantly influenced by the increasing emphasis on energy efficiency across various sectors. Thermal spray coatings contribute to energy savings by enhancing the lifespan and performance of machinery and equipment, thereby reducing maintenance costs and downtime. Industries such as power generation and manufacturing are adopting these coatings to improve the efficiency of their operations. As global energy demands rise, the need for efficient solutions becomes paramount, further driving the adoption of thermal spray coatings. This trend is likely to sustain the market's growth trajectory, with projections indicating a rise to 13.1 USD Billion by 2035.

Advancements in Coating Technologies

Technological advancements play a pivotal role in the Global Thermal Spray Coatings Market Industry, as innovations in coating materials and application techniques enhance performance and efficiency. Newer methods, such as High Velocity Oxygen Fuel (HVOF) and Plasma Spray, allow for finer control over coating properties, leading to improved adhesion and durability. These advancements not only meet the stringent requirements of industries like automotive and energy but also open new avenues for applications in emerging sectors. As a result, the market is expected to witness a compound annual growth rate of 4.08% from 2025 to 2035, reflecting the ongoing evolution of thermal spray technologies.

Increasing Demand in Aerospace Sector

The Global Thermal Spray Coatings Market Industry experiences heightened demand from the aerospace sector, where coatings are essential for enhancing the durability and performance of components. Thermal spray coatings provide excellent resistance to wear, corrosion, and thermal degradation, which are critical in high-stress environments like jet engines. As the aerospace industry continues to expand, driven by increasing air travel and the need for fuel-efficient aircraft, the market for thermal spray coatings is projected to grow. This growth is reflected in the anticipated market value of 8.45 USD Billion in 2024, indicating a robust trajectory for thermal spray applications in aerospace.

Diverse Applications Across Industries

The versatility of thermal spray coatings drives their adoption across a multitude of industries, including automotive, aerospace, and energy. This diversity in applications enhances the Global Thermal Spray Coatings Market Industry's resilience against economic fluctuations, as demand remains steady across various sectors. For instance, in the automotive industry, thermal spray coatings are utilized for engine components to improve wear resistance and longevity. Similarly, in the energy sector, these coatings protect components from harsh operating conditions. This broad applicability not only sustains market growth but also encourages innovation, as companies explore new uses for thermal spray technologies.

Regulatory Support for Advanced Coatings

Regulatory frameworks worldwide increasingly support the use of advanced coatings, including thermal spray coatings, due to their environmental benefits. Governments are promoting the adoption of coatings that reduce emissions and enhance the sustainability of industrial processes. This regulatory backing is particularly evident in sectors such as automotive and aerospace, where stringent environmental standards necessitate the use of innovative materials. The Global Thermal Spray Coatings Market Industry stands to benefit from these initiatives, as companies seek to comply with regulations while improving their product offerings. This supportive environment is expected to bolster market growth in the coming years.