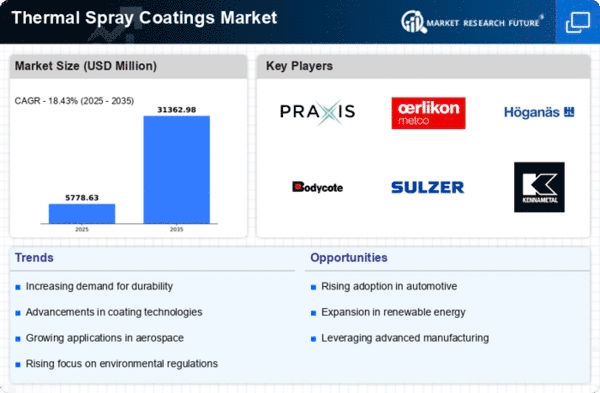

Top Industry Leaders in the Thermal Spray Coatings Market

The thermal spray coatings market is a fiercely competitive yet exciting space. Leaders are constantly innovating, developing new technologies, and expanding their reach into diverse applications. Understanding the strategies, factors shaping market share, and recent developments is crucial for players to navigate this dynamic market and secure a strong position. As the demand for advanced coatings grows, the future of thermal spray looks bright, promising continued innovation and market expansion.

Industry Leaders and Strategies:

-

Oerlikon Metco: A dominant player with a strong global presence, Oerlikon Metco focuses on offering a wide range of coating materials and technologies, including high-velocity oxyfuel (HVOF) and plasma spraying. Their recent acquisition of A.A.D. Engineering expands their reach in the medical device market. -

Sulzer Metco: Another major player, Sulzer Metco specializes in wear-resistant and corrosion-resistant coatings for various applications. They emphasize research and development, recently introducing new wear-resistant coatings for the mining industry. -

United Thermal Dynamics (UTD): A major North American player, UTD excels in thermal spray systems and equipment. Their recent focus on automation and process control improves efficiency and attracts customers seeking cost-effective solutions. -

Praxair Surface Technologies: Praxair leverages its expertise in industrial gases to offer custom coating solutions. Their recent partnership with Siemens Energy aims to develop advanced coatings for power generation turbines.

Factors for Market Share:

-

Technology Leadership: Companies with advanced coating technologies and materials, like nanostructured coatings or additive manufacturing integration, gain a competitive edge. -

Regional Presence: Strong presence in key growth markets like Asia and Eastern Europe offers access to a wider customer base. -

Focus on Application-Specific Solutions: Developing customized coatings for specific industry needs, like high-temperature coatings for jet engines, attracts customers. -

Sustainability and Environmental Initiatives: Eco-friendly coating materials and processes resonate with customers seeking responsible practices. -

Partnerships and Acquisitions: Strategic partnerships and acquisitions expand reach, technology portfolio, and market access.

The global expansion of the global market has been witnessing competition amongst the following market players:

- Praxair Surface Technologies, Inc (US)

- Oerlikon Metco (Switzerland)

- Plasma-Tec, Inc. (US)

- AMETEK Inc. (US)

- Gartner Thermal Spraying (US)

- Arc Spray (Pty) Ltd (South Africa)

- Metallisation Limited (UK)

Recent News

March 2021: Oerlikon Metco Coating Services (MCS) announced that it would concentrate its thermal spray and laser cladding activities in the United States and joined Oerlikon AM in North Carolina. In North Carolina, Oerlikon AM opened an additive manufacturing factory. Thermal spray and laser cladding capabilities, which are important aspects of Oerlikon Metco's service offering, were added to this facility as part of a significant investment. The company supplied 'print & coat' products by merging Oerlikon AM's additive manufacturing capabilities with Oerlikon Metco's coating capabilities under one roof. The expansion included not just cutting-edge coating and cladding equipment, but also pre- and post-coating inspection and machining services, as well as built-to-print replacement parts created to extremely tight tolerances using state-of-the-art CNC machines.