Rising Prevalence of Tendinitis

The increasing incidence of tendinitis across the Global Americas and Europe Tendinitis Treatment Market Industry is a notable driver. Factors such as aging populations, sedentary lifestyles, and increased participation in sports contribute to this trend. For instance, the prevalence of tendinitis is expected to rise significantly, leading to a projected market value of 6.47 USD Billion in 2024. This growing patient population necessitates effective treatment options, thereby driving demand for various therapeutic modalities, including physical therapy and pharmacological interventions.

Increased Awareness and Education

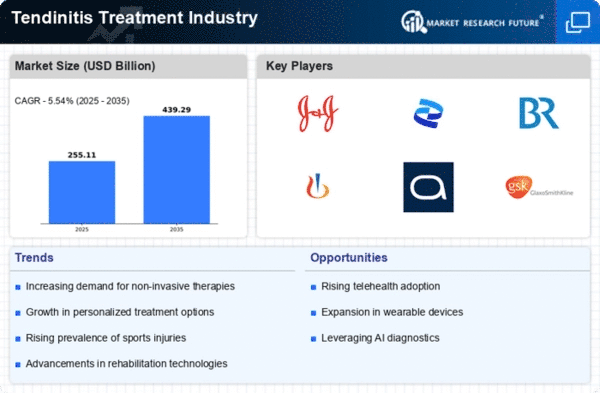

Heightened awareness regarding tendinitis and its treatment options is driving growth in the Global Americas and Europe Tendinitis Treatment Market Industry. Educational campaigns by healthcare organizations and sports associations aim to inform the public about prevention and management strategies. This increased awareness is likely to lead to earlier diagnosis and treatment, which can improve patient outcomes. As a result, the market may experience a steady growth trajectory, with a projected CAGR of 1.67% from 2025 to 2035, reflecting the positive impact of education on treatment uptake.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare access and funding for musculoskeletal disorders are influencing the Global Americas and Europe Tendinitis Treatment Market Industry. Various health departments are allocating resources to enhance treatment facilities and promote research into effective therapies. Such initiatives may lead to improved patient access to care and innovative treatment options. Consequently, this support is likely to bolster market growth, as increased funding can facilitate advancements in treatment technologies and enhance overall patient care.

Advancements in Treatment Modalities

Innovations in treatment modalities are transforming the Global Americas and Europe Tendinitis Treatment Market Industry. The introduction of minimally invasive procedures, regenerative medicine, and advanced physiotherapy techniques enhances patient outcomes. For example, platelet-rich plasma therapy has gained traction as a promising treatment option, potentially reducing recovery times. As these advanced treatments become more widely adopted, they are likely to contribute to the market's growth, with projections indicating a market value of 7.76 USD Billion by 2035.

Growing Demand for Non-Surgical Treatments

The shift towards non-surgical treatment options is a significant driver in the Global Americas and Europe Tendinitis Treatment Market Industry. Patients increasingly prefer conservative management strategies, such as physical therapy, corticosteroid injections, and over-the-counter medications, to avoid the risks associated with surgery. This trend is particularly evident among younger populations who are more health-conscious. As a result, the market is expected to expand, with a notable increase in the adoption of these non-invasive therapies, further contributing to the overall market growth.