Growing Aging Population

the growing elderly population in the US is another vital driver for the patellar tendinitis market. As individuals age, the risk of developing musculoskeletal disorders, including tendinitis, tends to rise. The demographic shift towards an older population, with projections indicating that by 2030, approximately 20% of the US population will be over 65 years old, suggests a growing need for effective treatment options. This demographic is more likely to seek medical attention for joint and tendon issues, thereby increasing the patient base for the patellar tendinitis market. Healthcare providers will need to adapt their services to cater to this aging population, potentially leading to a rise in specialized treatment programs and products.

Increased Awareness of Patellar Tendinitis

The growing awareness surrounding patellar tendinitis is a crucial driver for the patellar tendinitis market. Educational campaigns by healthcare professionals and sports organizations have highlighted the condition's prevalence, particularly among athletes. This heightened awareness has led to an increase in early diagnosis and treatment, which is essential for effective management. As more individuals recognize the symptoms and seek medical advice, the demand for treatment options is likely to rise. In the US, the number of diagnosed cases has reportedly increased by approximately 15% over the past few years, indicating a shift towards proactive healthcare. This trend suggests that the patellar tendinitis market will continue to expand as more patients seek interventions, thereby driving growth in related products and services.

Increased Focus on Rehabilitation and Recovery

The heightened focus on rehabilitation and recovery in sports medicine is significantly influencing the patellar tendinitis market. Athletes and active individuals are increasingly prioritizing recovery strategies to prevent injuries and enhance performance. This trend has led to a greater emphasis on physical therapy, rehabilitation programs, and supportive devices designed to aid recovery from patellar tendinitis. The market for rehabilitation products, including braces and therapeutic modalities, is expected to expand as more individuals seek effective solutions to manage their conditions. With an estimated growth rate of 8% in the rehabilitation sector, the patellar tendinitis market stands to benefit from this shift towards comprehensive recovery strategies.

Technological Innovations in Treatment Options

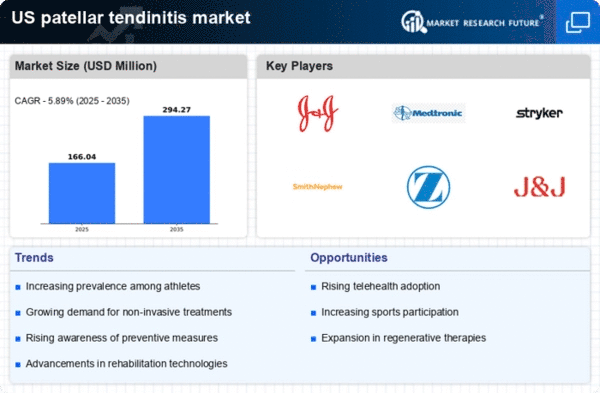

Technological advancements in treatment options are reshaping the landscape of the patellar tendinitis market. Innovations such as regenerative medicine, including platelet-rich plasma (PRP) therapy and stem cell treatments, are gaining traction among healthcare providers. These cutting-edge therapies offer promising results for patients suffering from chronic tendinitis, potentially reducing recovery times and improving outcomes. The market for these advanced treatments is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of around 10% over the next five years. As healthcare professionals increasingly adopt these technologies, the patellar tendinitis market is likely to experience a surge in demand for these innovative solutions.

Rising Participation in Sports and Fitness Activities

The surge in participation in sports and fitness activities is significantly impacting the patellar tendinitis market. As more individuals engage in high-impact sports, the incidence of related injuries, including patellar tendinitis, is likely to increase. According to recent statistics, nearly 60% of adults in the US participate in some form of physical activity, with a notable rise in youth sports participation. This trend creates a larger patient pool for healthcare providers, leading to increased demand for treatment options. Consequently, the patellar tendinitis market is expected to benefit from this growing demographic, as more athletes and fitness enthusiasts seek preventive measures and therapeutic solutions to manage their conditions effectively.