Market Analysis

In-depth Analysis of Tendinitis Treatment Industry Industry Landscape

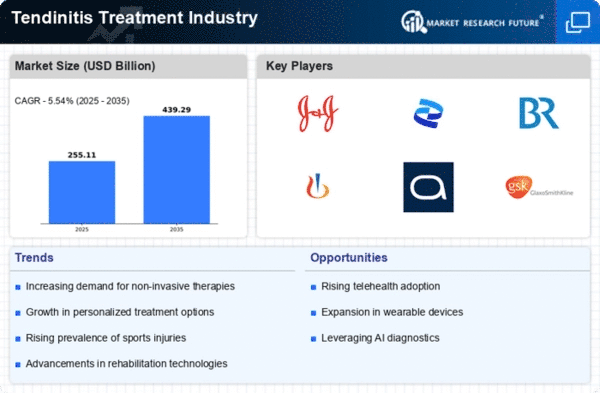

The market dynamics of Tendinitis Treatment within the Americas and Europe revolve around addressing the ordinary musculoskeletal circumstance characterized by infection of the tendons. Understanding the regional versions, treatment modalities, and demographic elements is essential in shaping the market panorama for tendinitis control. Market dynamics are inspired by the various incidences of tendinitis throughout the Americas and Europe. Demographic elements, consisting of age, lifestyle, and occupational choices, contribute to the incidence of tendinitis. Recognizing these regional nuances is important for tailoring remedy strategies and allocating healthcare sources successfully. The market dynamics are formed by using the diverse remedy modalities available for tendinitis, such as relaxation, physical remedy, medications (non-steroidal anti-inflammatory drugs - NSAIDs), corticosteroid injections, and, in a few instances, surgical intervention. Adherence to clinical guidelines and contemporary research findings informs healthcare practices and influences the selection of treatment modalities. Lifestyle and occupational factors notably affect market dynamics. Individuals engaged in repetitive or strenuous sports, which includes athletes or guide laborers, are greatly liable to tendinitis. Market strategies don't forget the effect of lifestyle selections and work-associated elements on the superiority of tendinitis and tailor interventions accordingly. Market dynamics contain efforts to grow patient schooling and cognizance about tendinitis, its threat factors, and the significance of early intervention. Empowering people to understand signs and searching for well-timed medical interests contributes to advanced results and an extra proactive technique for tendinitis control. Regional variations in healthcare infrastructure influence market dynamics. Disparities in access to specialized care, rehabilitation centers, and superior remedy alternatives might also impact the general management of tendinitis. The practices of healthcare specialists, including orthopedic experts, physiotherapists, and primary care physicians, significantly have an impact on market dynamics. Continuous schooling in the latest remedy modalities, rehabilitation techniques, and patient management methods is vital for optimizing tendinitis care. Effective ache control is an essential thing of market dynamics in Tendinitis Treatment. Balancing pain relief with the upkeep of features and mobility is a key attention. The market adapts based totally on the availability and usage of pain control strategies that align with patient preferences and universal treatment goals. The regulatory surroundings inside the Americas and Europe contribute to market dynamics. Approval tactics for new treatments, repayment guidelines, and regulatory compliance affect the accessibility of remedy alternatives. Market strategies need to align with local policies to ensure the successful introduction and adoption of Tendinitis Treatments.

Leave a Comment