Telecom Analytics Market Summary

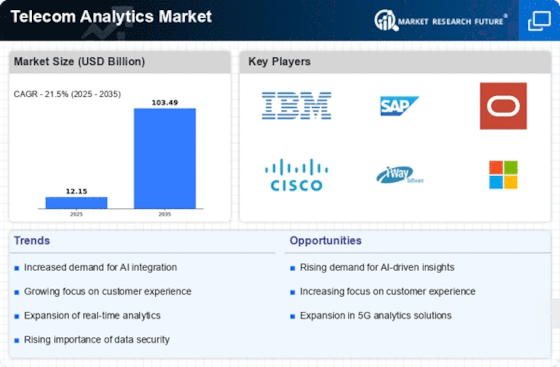

As per Market Research Future analysis, the Telecom Analytics Market Size was estimated at 12.15 USD Billion in 2024. The Telecom Analytics industry is projected to grow from 14.76 USD Billion in 2025 to 103.49 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 21.5% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Telecom Analytics Market is poised for substantial growth driven by technological advancements and evolving consumer demands.

- Real-time data processing is becoming increasingly essential for telecom operators to enhance operational efficiency.

- The adoption of predictive analytics is gaining traction as companies seek to anticipate customer needs and improve service delivery.

- Integration of IoT analytics is transforming the landscape, enabling better insights into network performance and customer behavior.

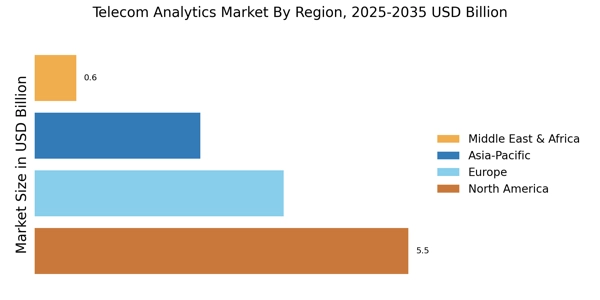

- The growing demand for enhanced customer experience and the rise of big data technologies are key drivers propelling market expansion in North America and Asia-Pacific.

Market Size & Forecast

| 2024 Market Size | 12.15 (USD Billion) |

| 2035 Market Size | 103.49 (USD Billion) |

| CAGR (2025 - 2035) | 21.5% |

Major Players

IBM (US), SAP (DE), Oracle (US), Cisco (US), TIBCO Software (US), Microsoft (US), Nokia (FI), Ericsson (SE), Amdocs (IL), Teradata (US)