Emergence of 5G Technology

The emergence of 5G technology is poised to transform the telecom analytics market significantly. As 5G networks roll out across the United States, the volume of data generated will increase exponentially, necessitating advanced analytics solutions to manage and interpret this data effectively. By 2025, it is anticipated that the telecom analytics market will see a substantial uptick in demand for analytics tools tailored for 5G environments. This includes the need for real-time analytics to support low-latency applications and enhanced user experiences. Consequently, telecom operators are likely to invest heavily in analytics capabilities to harness the full potential of 5G technology, thereby driving growth in the telecom analytics market.

Increased Regulatory Pressures

Increased regulatory pressures are shaping the landscape of the telecom analytics market. As data privacy and security regulations become more stringent, telecom operators must ensure compliance while leveraging analytics for business intelligence. In 2025, it is expected that compliance-related investments in analytics will account for a significant portion of the market, as companies seek to navigate complex regulatory frameworks. This includes the implementation of analytics solutions that can monitor data usage and ensure adherence to privacy laws. The need for robust compliance measures is likely to drive innovation in the telecom analytics market, as operators develop solutions that balance regulatory requirements with the need for actionable insights.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) is significantly influencing the telecom analytics market. These technologies enable telecom operators to process vast amounts of data more efficiently, leading to improved decision-making and predictive analytics capabilities. In 2025, it is estimated that AI-driven analytics solutions will account for over 30% of the total market share. This shift towards automation and intelligent analytics allows companies to optimize network operations, enhance customer experiences, and reduce operational costs. As a result, the telecom analytics market is likely to witness accelerated growth as organizations increasingly adopt these advanced technologies to stay competitive.

Growing Focus on Network Optimization

The telecom analytics market is witnessing a growing focus on network optimization as operators strive to enhance service delivery and reduce operational costs. With the increasing complexity of network infrastructures, analytics tools are essential for monitoring performance and identifying areas for improvement. In 2025, it is projected that investments in network optimization analytics will exceed $2 billion, driven by the need for real-time data analysis and proactive maintenance strategies. By leveraging analytics, telecom companies can optimize resource allocation, minimize downtime, and improve overall network reliability. This emphasis on network optimization is likely to propel the telecom analytics market forward, as operators seek to deliver superior services to their customers.

Rising Demand for Data-Driven Insights

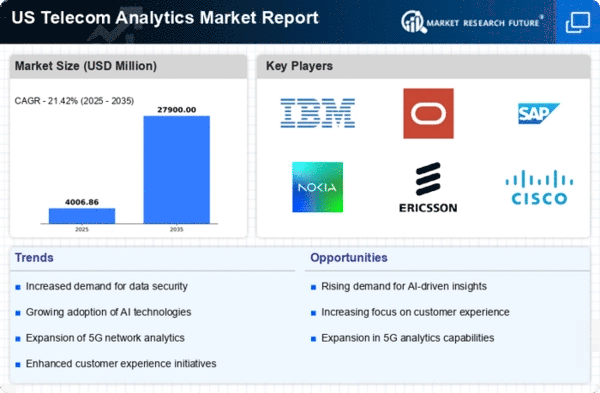

The telecom analytics market is experiencing a notable surge in demand for data-driven insights. As telecom operators seek to enhance operational efficiency and customer satisfaction, the utilization of analytics tools becomes paramount. In 2025, the market is projected to reach approximately $5 billion, reflecting a compound annual growth rate (CAGR) of around 15% from previous years. This growth is largely attributed to the increasing volume of data generated by mobile and broadband services. Telecom companies are leveraging analytics to gain actionable insights into customer behavior, network performance, and service quality. Consequently, the ability to harness big data analytics is becoming a critical differentiator in the competitive landscape of the telecom analytics market.