Market Trends

Key Emerging Trends in the Telecom Analytics Market

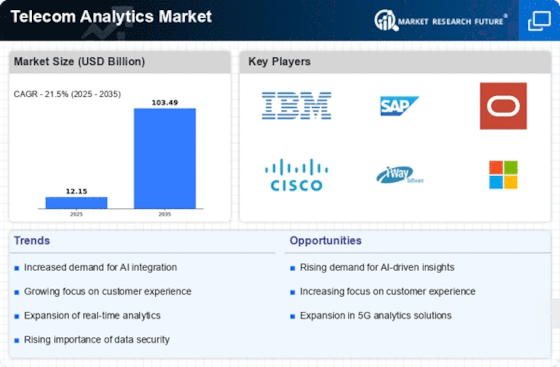

The Telecom Analytics market is experiencing notable trends that reflect the industry's response to the evolving telecommunications landscape. One prominent trend is the increasing reliance on big data analytics to extract meaningful insights from the vast amount of data generated by telecom networks. With the exponential growth of data traffic and the proliferation of connected devices, telecom companies are leveraging advanced analytics tools to gain a deeper understanding of customer behavior, optimize network performance, and enhance overall operational efficiency.

Moreover, there is a growing emphasis on customer experience management within the Telecom Analytics market. Telecom operators are recognizing the importance of delivering exceptional services to retain and attract customers in a highly competitive environment. Analytics solutions are being employed to analyze customer interactions, preferences, and feedback, enabling telecom companies to tailor their services and improve the overall customer experience. This customer-centric approach is becoming a key differentiator in the telecom industry.

The Telecom Analytics market is also witnessing a surge in demand for predictive analytics. Telecom operators are leveraging predictive modeling and analytics to anticipate network issues, identify potential service disruptions, and proactively address them before they impact users. This proactive approach helps in minimizing downtime, improving network reliability, and ensuring a seamless communication experience for subscribers.

Another significant trend is the integration of artificial intelligence (AI) and machine learning (ML) into Telecom Analytics solutions. These advanced technologies empower telecom operators to automate complex analytical tasks, detect anomalies in network behavior, and optimize resource allocation. By harnessing the power of AI and ML, telecom companies can enhance the efficiency of their operations, reduce costs, and provide more intelligent and adaptive services to their customers.

The Telecom Analytics market is undergoing a shift towards real-time analytics capabilities. In an era where instant communication is the norm, telecom operators are investing in analytics solutions that can process and analyze data in real-time. This enables swift decision-making, rapid response to network issues, and the ability to capitalize on emerging opportunities quickly. Real-time analytics is particularly crucial for ensuring the seamless functioning of telecom networks and meeting the increasing demand for low-latency services.

Additionally, there is a growing interest in the adoption of cloud-based Telecom Analytics solutions. Cloud platforms offer scalability, flexibility, and cost-effectiveness, allowing telecom companies to efficiently manage and analyze vast amounts of data. Cloud-based solutions enable operators to overcome the challenges of data silos and legacy systems, fostering a more integrated and streamlined analytics environment.

As telecom networks transition to 5G technology, the Telecom Analytics market is witnessing increased focus on 5G network analytics. Telecom operators are leveraging analytics tools to optimize 5G network performance, enhance quality of service, and manage the complexities associated with the deployment of this next-generation technology. The rollout of 5G is driving the need for advanced analytics capabilities to unlock the full potential of this transformative technology.

Leave a Comment