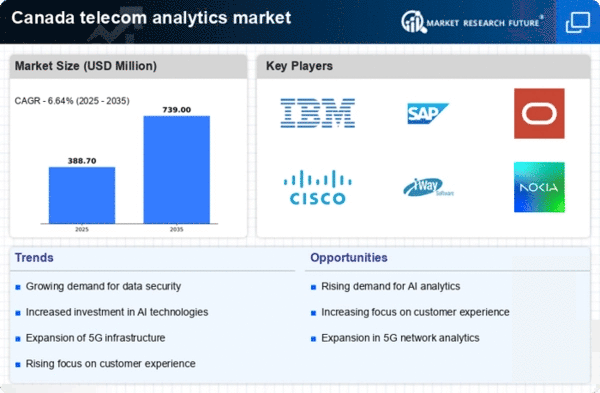

Emergence of 5G Technology

The rollout of 5G technology in Canada significantly impacts the telecom analytics market. With the introduction of 5G, telecom operators are presented with unprecedented opportunities to collect and analyze vast amounts of data at higher speeds. This technological advancement necessitates robust analytics solutions to manage the increased data flow effectively. The telecom analytics market is likely to see a substantial increase in investments, as companies seek to leverage 5G capabilities to enhance service delivery and customer experiences. By 2025, it is estimated that 5G will account for over 30% of mobile subscriptions in Canada, further driving the demand for analytics tools that can harness the potential of this new technology.

Growing Demand for Data-Driven Insights

The telecom analytics market in Canada experiences a notable surge in demand for data-driven insights. As telecommunications companies increasingly rely on data analytics to enhance operational efficiency, the need for sophisticated analytical tools becomes paramount. In 2025, the market is projected to reach approximately $1.5 billion, reflecting a compound annual growth rate (CAGR) of around 12% from previous years. This growth is driven by the necessity for telecom operators to make informed decisions based on real-time data analysis. Consequently, the telecom analytics market is witnessing a shift towards advanced analytics solutions that can process vast amounts of data, enabling companies to optimize their services and improve customer satisfaction.

Increased Competition Among Telecom Providers

The competitive landscape among telecom providers in Canada drives innovation within the telecom analytics market. As companies strive to differentiate themselves, they increasingly turn to analytics to gain insights into customer behavior and preferences. This competitive pressure encourages the development of advanced analytics solutions that can provide a competitive edge. The telecom analytics market is expected to benefit from this trend, as operators invest in tools that enable them to analyze customer data more effectively. By 2025, it is projected that analytics spending among telecom providers will increase by approximately 15%, reflecting the industry's commitment to leveraging data for strategic advantage.

Regulatory Changes and Compliance Requirements

The telecom analytics market in Canada is influenced by evolving regulatory changes and compliance requirements. As the government implements stricter regulations regarding data privacy and security, telecom operators must adapt their analytics strategies accordingly. This shift creates a demand for analytics solutions that ensure compliance while providing valuable insights. The telecom analytics market is likely to see an increase in the adoption of compliance-focused analytics tools, which can help operators navigate the complex regulatory landscape. By 2025, it is anticipated that compliance-related investments will constitute approximately 20% of total analytics spending in the telecom sector, underscoring the importance of regulatory alignment in shaping market dynamics.

Focus on Operational Efficiency and Cost Reduction

The telecom analytics market in Canada is significantly influenced by the focus on operational efficiency and cost reduction. Telecom operators are increasingly seeking ways to streamline their operations and reduce costs, prompting a greater reliance on analytics to identify inefficiencies. The telecom analytics market is likely to see a rise in demand for solutions that can provide actionable insights into operational processes. By 2025, it is estimated that analytics-driven cost reduction initiatives will lead to savings of up to $500 million across the sector, highlighting the critical role of analytics in enhancing operational performance and driving profitability.