Technological Advancements

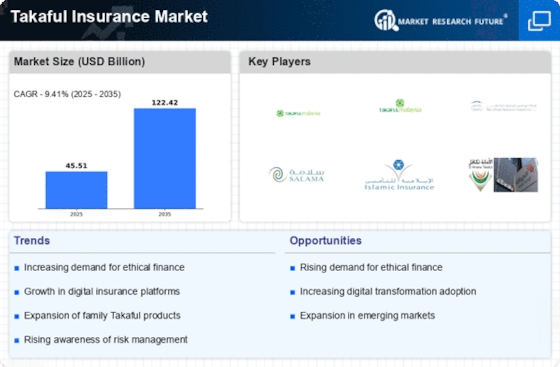

Technological advancements are reshaping the Takaful Insurance Market, facilitating improved customer engagement and operational efficiency. The integration of digital platforms and mobile applications has enabled Takaful providers to reach a wider audience, streamline processes, and enhance service delivery. For instance, the adoption of artificial intelligence and big data analytics allows insurers to better understand customer needs and tailor products accordingly. Recent data suggests that the use of technology in the insurance sector has led to a 20% increase in customer satisfaction rates. As technology continues to evolve, it is expected to play a crucial role in driving innovation and growth within the Takaful Insurance Market.

Regulatory Framework Enhancements

The enhancement of regulatory frameworks surrounding Takaful insurance is a significant driver for the Takaful Insurance Market. Governments and regulatory bodies are increasingly recognizing the importance of Takaful as a compliant financial solution that adheres to Sharia principles. This recognition has led to the establishment of clearer guidelines and standards, fostering a more conducive environment for Takaful operators. For example, recent regulatory reforms in several regions have resulted in a 30% increase in new Takaful licenses issued. Such developments not only bolster consumer confidence but also attract investments, thereby stimulating growth within the Takaful Insurance Market.

Growing Awareness of Islamic Finance

The increasing awareness of Islamic finance principles among consumers is a pivotal driver for the Takaful Insurance Market. As more individuals seek financial products that align with their ethical and religious beliefs, Takaful insurance offers a compelling alternative to conventional insurance. This shift is evidenced by a reported growth rate of approximately 15% in Takaful contributions over the past few years. The rise in awareness is not limited to specific demographics; it spans various age groups and income levels, indicating a broader acceptance of Takaful as a viable financial solution. Consequently, this growing awareness is likely to enhance the market's penetration and foster a more competitive landscape within the Takaful Insurance Market.

Increased Focus on Sustainable Practices

The increased focus on sustainable practices is emerging as a vital driver for the Takaful Insurance Market. As consumers become more environmentally conscious, they are seeking financial products that reflect their values. Takaful insurance, with its ethical investment principles, aligns well with this demand for sustainability. Recent studies indicate that Takaful operators that incorporate sustainable practices into their business models have experienced a 15% growth in customer acquisition. This trend suggests that the Takaful Insurance Market is not only responding to consumer preferences but is also positioning itself as a leader in promoting responsible financial solutions.

Rising Demand for Family Takaful Products

The rising demand for family Takaful products is a notable driver within the Takaful Insurance Market. As families increasingly prioritize financial security and protection against unforeseen events, family Takaful plans have gained traction. These products offer a unique blend of savings and protection, appealing to consumers seeking long-term financial planning solutions. Market data indicates that family Takaful contributions have surged by approximately 25% in recent years, reflecting a shift in consumer preferences towards more holistic financial products. This trend is likely to continue, as families recognize the value of Takaful in safeguarding their financial future within the Takaful Insurance Market.