Emerging Markets

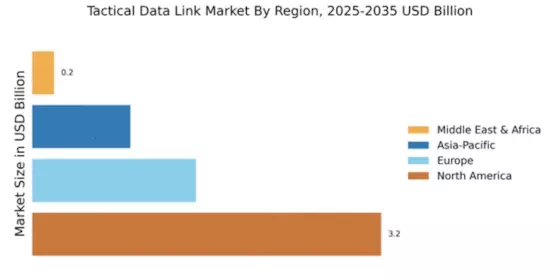

Emerging markets are becoming increasingly relevant in the Global Tactical Data Link Market Industry. Countries in regions such as Asia-Pacific and the Middle East are investing in modernizing their military capabilities, recognizing the strategic importance of advanced communication systems. For instance, nations like India and Saudi Arabia are actively pursuing defense procurement programs that prioritize tactical data link technologies. This trend is likely to create new opportunities for market players, as these countries seek to enhance their operational effectiveness. The anticipated growth in these regions contributes to the overall market expansion, aligning with the broader global defense landscape.

Geopolitical Tensions

Geopolitical tensions significantly influence the Global Tactical Data Link Market Industry. Heightened conflicts and territorial disputes compel nations to bolster their defense capabilities, leading to increased demand for tactical data link systems. For instance, ongoing tensions in Eastern Europe and the Asia-Pacific region have prompted countries to invest in advanced communication technologies to ensure operational readiness. This trend is likely to sustain market growth, as nations seek to enhance interoperability among allied forces. The projected compound annual growth rate of 2.78% from 2025 to 2035 indicates a sustained focus on tactical data links as a critical component of national security strategies.

Increasing Defense Budgets

The Global Tactical Data Link Market Industry is experiencing growth driven by rising defense budgets across various nations. Countries are prioritizing modernization of their military capabilities, leading to increased investments in advanced communication systems. For instance, the United States has allocated substantial funds to enhance its tactical data link systems, reflecting a broader trend among NATO allies. This focus on upgrading military infrastructure is expected to contribute to the market's expansion, with projections indicating a market value of 923 USD Billion in 2024. Such financial commitments underscore the importance of tactical data links in contemporary defense strategies.

Technological Advancements

Technological innovations play a pivotal role in shaping the Global Tactical Data Link Market Industry. The integration of artificial intelligence and machine learning into tactical data systems enhances real-time decision-making and situational awareness. For example, advancements in data encryption and cybersecurity measures are crucial for protecting sensitive military communications. These developments not only improve operational efficiency but also attract investments from defense contractors seeking to provide cutting-edge solutions. As a result, the market is poised for growth, with expectations of reaching 1247.5 USD Billion by 2035, reflecting the ongoing evolution of military communication technologies.

Interoperability Requirements

The need for interoperability among allied forces is a driving factor in the Global Tactical Data Link Market Industry. As military operations increasingly involve multinational coalitions, the ability to share data seamlessly across different platforms becomes essential. This requirement has led to the development of standardized protocols and systems that facilitate communication between diverse military assets. For example, NATO's initiatives to enhance interoperability among member nations underscore the importance of tactical data links in joint operations. This growing emphasis on collaborative defense efforts is expected to propel market growth, aligning with the projected increase in market value over the next decade.