Top Industry Leaders in the Tactical Data Link Market

Tactical Data Link Market

- Technological Innovation: Key players invest in research and development to enhance tactical data link systems' capabilities, including improved data throughput, interoperability, and cybersecurity features, to meet evolving military communication requirements.

- Partnerships and Collaborations: Forming strategic partnerships and alliances with government agencies, defense contractors, and technology providers enables companies to access complementary expertise, expand market reach, and deliver integrated solutions tailored to customer needs.

- Focus on Interoperability: Companies prioritize interoperability with legacy and future systems, standardizing protocols, and interfaces to ensure seamless communication and data exchange between diverse military platforms and networks.

- Customer-Centric Solutions: Offering customer-centric solutions, including training, technical support, and system integration services, enhances companies' competitiveness by providing comprehensive support throughout the system lifecycle.

Strategies Adopted By Tactical Data Link Market Key Players

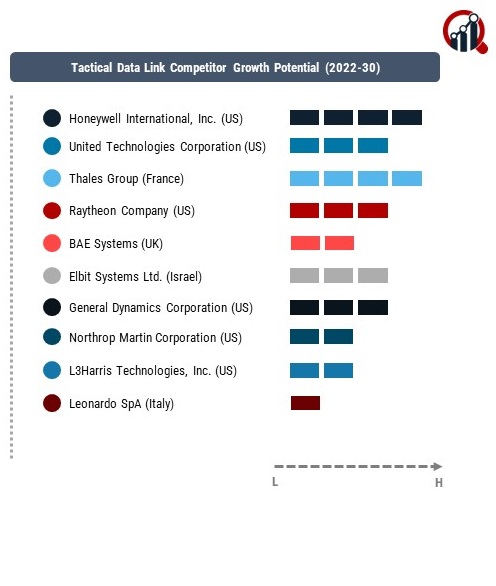

- Honeywell International, Inc. (US)

- United Technologies Corporation (US)

- Thales Group (France)

- Raytheon Company (US)

- BAE Systems (UK)

- Elbit Systems Ltd. (Israel)

- General Dynamics Corporation (US)

- Northrop Martin Corporation (US)

- L3Harris Technologies, Inc. (US)

- Leonardo SpA (Italy)

Factors for Market Share Analysis:

- System Performance: Companies offering tactical data link systems with superior performance, reliability, and scalability gain market share by meeting military requirements for robust, real-time communication capabilities in complex operational environments.

- Integration Capabilities: Providers offering integrated solutions that seamlessly connect tactical data link systems with command and control networks, sensors, and weapons platforms secure market share by enabling enhanced situational awareness and mission effectiveness.

- Global Reach: Companies with a global presence, established customer relationships, and regional offices maintain market share by effectively serving diverse military customers, addressing regional requirements, and adapting products to local operational environments.

- Compliance with Standards: Compliance with international standards and interoperability requirements, such as Link 16, Link 22, and NATO STANAGs, enhances companies' competitiveness by ensuring compatibility and connectivity with allied forces and coalition partners.

Industry News:

- Contract Awards: News of contract awards, project wins, and government procurements highlight companies' success in securing business opportunities and driving revenue growth in the tactical data link market.

- Technology Demonstrations: Demonstrations of new tactical data link technologies, interoperability tests, and system upgrades showcase companies' innovation capabilities and commitment to advancing military communication capabilities.

- Mergers and Acquisitions: Mergers, acquisitions, and strategic partnerships reshape the competitive landscape by consolidating market players, expanding product portfolios, and enhancing market competitiveness.

- International Collaborations: Collaborations between companies, defense ministries, and international organizations on joint development projects and interoperability initiatives demonstrate efforts to promote international cooperation and standardization in tactical data link systems.

Current Company Investment Trends:

- Research and Development: Investments in research and development focus on developing next-generation tactical data link technologies, including waveform advancements, secure data transmission, and network-centric capabilities, to address emerging military communication requirements and threats.

- Cybersecurity Solutions: Increasing investments in cybersecurity solutions, including encryption, authentication, and intrusion detection systems, aim to enhance tactical data link systems' resilience against cyber threats and ensure secure communication and data protection.

- Global Expansion: Investments in global expansion initiatives, such as establishing regional offices, forming partnerships, and participating in international defense exhibitions, facilitate market penetration, customer engagement, and business development efforts.

- Training and Support Services: Investments in training and support services, including simulation systems, training exercises, and technical assistance programs, aim to enhance military operators' proficiency, system readiness, and operational effectiveness, fostering long-term customer relationships and loyalty.