Rising Geopolitical Tensions

The Defense Electronics Market appears to be significantly influenced by rising geopolitical tensions across various regions. Nations are increasingly investing in advanced defense systems to enhance their military capabilities. This trend is evident as defense budgets have seen a marked increase, with many countries allocating substantial resources towards modernizing their defense electronics. For instance, the United States has proposed a defense budget exceeding 700 billion dollars, emphasizing the need for advanced technologies. Such investments are likely to drive demand for sophisticated electronic systems, including radar, communication, and surveillance technologies, which are crucial for national security. As tensions escalate, the Defense Electronics Market is poised for growth, with countries prioritizing the development and procurement of cutting-edge defense electronics.

Increased Focus on Cybersecurity

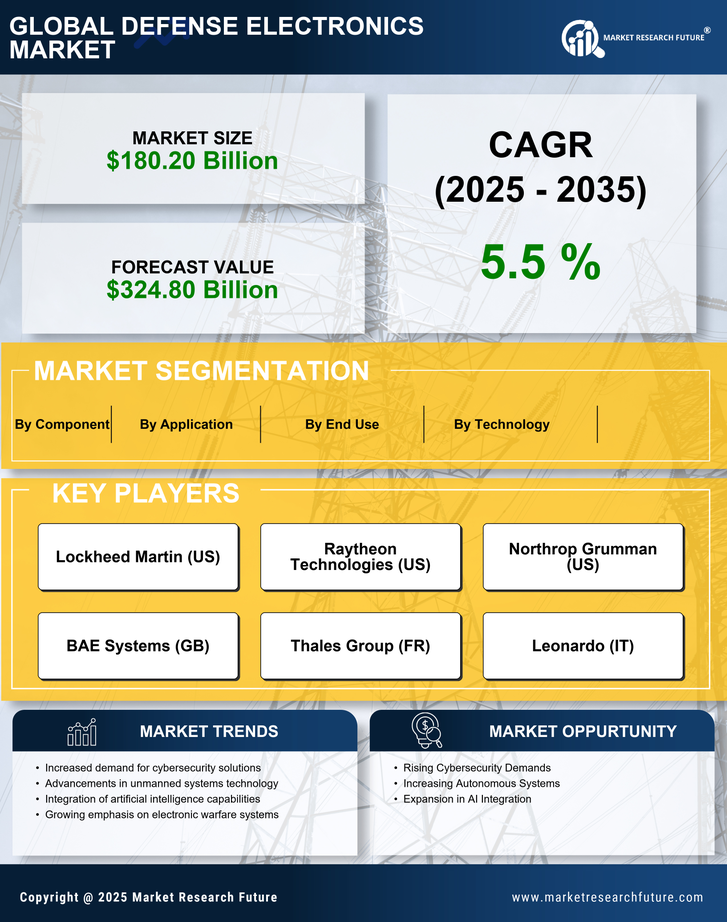

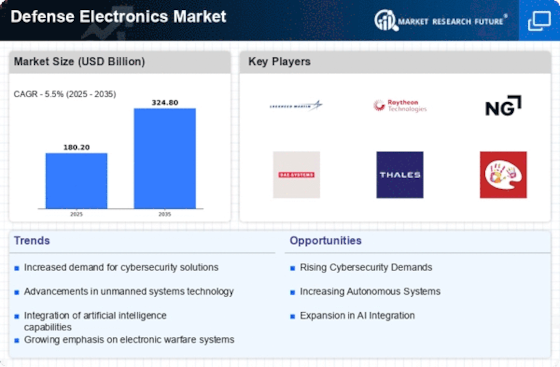

As cyber threats continue to evolve, the Defense Electronics Market is witnessing an increased focus on cybersecurity solutions. Governments and defense organizations are recognizing the critical need to protect their electronic systems from cyberattacks, which can compromise national security. Investments in cybersecurity technologies are expected to rise, with estimates indicating a market growth rate of around 15% annually. This trend is driving the development of secure communication systems, encryption technologies, and advanced threat detection systems. The emphasis on cybersecurity not only enhances the resilience of defense electronics but also ensures the integrity of sensitive military operations. Thus, the Defense Electronics Market is adapting to these challenges by prioritizing cybersecurity measures in the design and implementation of defense systems.

Emerging Markets and Defense Spending

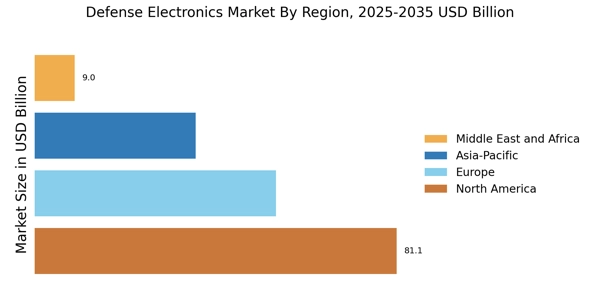

Emerging markets are playing an increasingly vital role in the Defense Electronics Market, as many countries are ramping up their defense spending. Nations in Asia, the Middle East, and Africa are investing heavily in their military capabilities, driven by regional security concerns and the desire to enhance their defense infrastructure. For instance, countries like India and Saudi Arabia have announced substantial increases in their defense budgets, with projections indicating a growth rate of around 8% annually. This trend is fostering a demand for advanced defense electronics, including surveillance systems, communication networks, and missile defense technologies. As these emerging markets continue to expand their defense capabilities, the Defense Electronics Market is likely to see significant growth opportunities.

Technological Advancements in Defense Systems

Technological advancements are reshaping the Defense Electronics Market, as innovations in electronics and software are leading to the development of more sophisticated defense systems. The integration of advanced technologies such as artificial intelligence, machine learning, and the Internet of Things is enhancing the capabilities of defense electronics. For example, the market for military drones and unmanned systems is projected to grow significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years. These advancements not only improve operational efficiency but also provide strategic advantages in various military operations. Consequently, the Defense Electronics Market is experiencing a surge in demand for next-generation electronic systems that can support modern warfare requirements.

Growing Demand for Modernization of Military Equipment

The Defense Electronics Market is experiencing a growing demand for the modernization of military equipment. Many nations are recognizing the necessity to upgrade their aging defense systems to maintain operational effectiveness and strategic superiority. This modernization trend is reflected in increased procurement of advanced electronic systems, including radar, communication, and electronic warfare technologies. Reports indicate that defense spending on modernization initiatives is expected to reach over 200 billion dollars in the next few years. Such investments are aimed at enhancing the capabilities of existing military platforms and ensuring they are equipped with the latest technologies. Consequently, the Defense Electronics Market is likely to benefit from this shift towards modernization, as countries seek to enhance their defense readiness.