Environmental Regulations and Compliance

The Synthetic Lubricants and Functional Fluids Market is significantly influenced by stringent environmental regulations. Governments worldwide are increasingly implementing policies aimed at reducing emissions and promoting sustainability. As a result, industries are compelled to transition from conventional lubricants to synthetic alternatives that are less harmful to the environment. This shift not only aids in compliance with regulations but also enhances the overall sustainability profile of companies. The market for biodegradable synthetic lubricants, for instance, is expected to witness substantial growth, as businesses seek to align with eco-friendly practices. The increasing focus on environmental stewardship is likely to propel the demand for synthetic lubricants in various applications.

Growing Industrialization and Urbanization

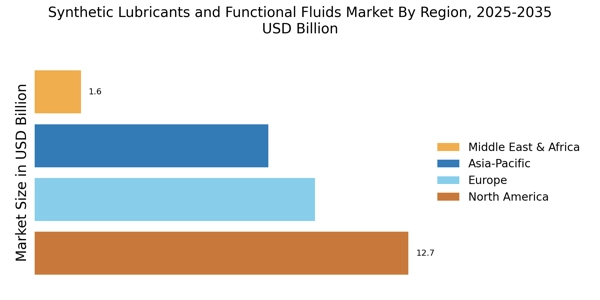

The Synthetic Lubricants and Functional Fluids Market is poised for growth due to the accelerating pace of industrialization and urbanization. As economies develop, there is a corresponding increase in manufacturing activities, which drives the demand for efficient lubricants. Industries such as construction, mining, and manufacturing are increasingly relying on synthetic lubricants to enhance machinery performance and reduce downtime. The rise in urban infrastructure projects further contributes to this demand, as heavy machinery and equipment require high-quality lubricants to operate effectively. Market analysts suggest that this trend will continue, with the synthetic lubricants market expected to expand in tandem with industrial growth.

Diverse Applications Across Multiple Sectors

The versatility of synthetic lubricants is a key driver in the Synthetic Lubricants and Functional Fluids Market. These lubricants find applications across a wide range of sectors, including automotive, aerospace, manufacturing, and energy. Their ability to perform under extreme conditions makes them suitable for various uses, from engine oils to hydraulic fluids. The automotive sector, in particular, is witnessing a shift towards synthetic options as consumers demand better fuel efficiency and engine protection. Additionally, the energy sector is increasingly adopting synthetic lubricants for wind turbines and other renewable energy applications. This diversity in application not only broadens the market scope but also enhances the growth potential of synthetic lubricants.

Rising Demand for High-Performance Lubricants

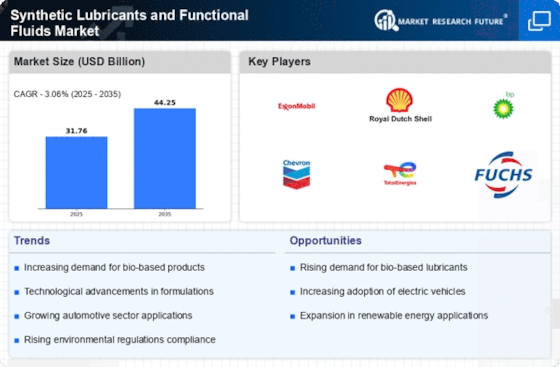

The Synthetic Lubricants and Functional Fluids Market is experiencing a notable increase in demand for high-performance lubricants. This trend is largely driven by the automotive and industrial sectors, where the need for enhanced efficiency and reduced friction is paramount. As manufacturers strive to meet stringent performance standards, the adoption of synthetic lubricants has surged. According to recent data, the market for synthetic lubricants is projected to grow at a compound annual growth rate (CAGR) of approximately 4.5% over the next few years. This growth is indicative of a broader shift towards products that offer superior thermal stability and oxidation resistance, which are essential for modern machinery and engines.

Technological Innovations in Lubricant Formulation

Technological advancements play a crucial role in shaping the Synthetic Lubricants and Functional Fluids Market. Innovations in formulation technologies have led to the development of synthetic lubricants that offer improved performance characteristics, such as enhanced wear protection and extended service life. These advancements are particularly relevant in sectors like aerospace and automotive, where the operational demands are exceptionally high. The introduction of nanotechnology in lubricant formulations, for example, has shown promise in enhancing the lubricating properties of synthetic fluids. As manufacturers continue to invest in research and development, the market is likely to see a proliferation of innovative products that cater to specific industry needs.