Expansion of Automotive Sector

The expansion of the automotive sector is a key driver for the Hydraulic Fluid Market. As vehicle manufacturers increasingly incorporate hydraulic systems for braking, steering, and suspension, the demand for hydraulic fluids is likely to rise. In 2025, the automotive industry is projected to grow at a rate of 4%, which will directly impact the consumption of hydraulic fluids. This growth is further fueled by the increasing production of electric and hybrid vehicles, which often utilize advanced hydraulic systems. Consequently, the Hydraulic Fluid Market is poised for growth as automotive manufacturers seek high-quality hydraulic fluids to enhance vehicle performance and safety.

Rising Demand in Construction Sector

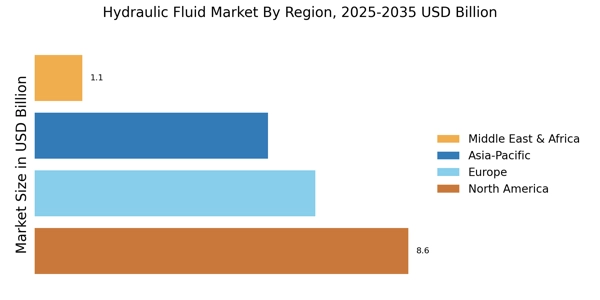

The Hydraulic Fluid Market experiences a notable surge in demand driven by the construction sector. As infrastructure projects expand, the need for hydraulic systems in construction machinery increases. In 2025, the construction industry is projected to grow at a rate of approximately 5.5% annually, which directly correlates with the rising consumption of hydraulic fluids. These fluids are essential for the efficient operation of excavators, cranes, and other heavy machinery. Consequently, manufacturers are focusing on producing high-performance hydraulic fluids that can withstand extreme conditions, thereby enhancing machinery efficiency and longevity. This trend indicates a robust growth trajectory for the Hydraulic Fluid Market, as construction activities continue to proliferate across various regions.

Increased Adoption of Renewable Energy

The Hydraulic Fluid Market is witnessing a shift due to the increased adoption of renewable energy sources. Wind and solar energy projects often utilize hydraulic systems for various applications, including turbine operation and solar panel adjustments. As countries invest in renewable energy infrastructure, the demand for hydraulic fluids tailored for these applications is likely to rise. In 2025, the renewable energy sector is expected to expand significantly, potentially increasing the market for hydraulic fluids by an estimated 10%. This growth reflects a broader trend towards sustainability and efficiency, positioning the Hydraulic Fluid Market favorably in the context of global energy transitions.

Technological Innovations in Fluid Formulation

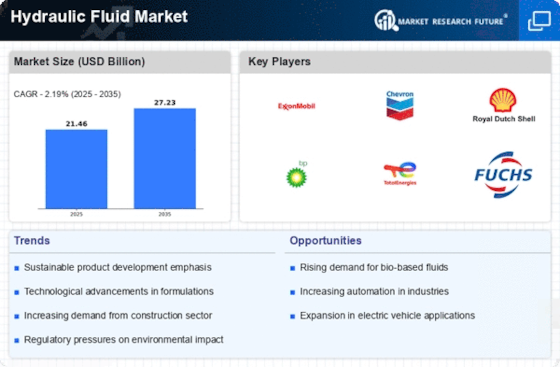

Technological innovations play a crucial role in shaping the Hydraulic Fluid Market. Advances in fluid formulation, such as the development of bio-based and synthetic hydraulic fluids, are gaining traction. These innovations not only enhance performance but also address environmental concerns associated with traditional fluids. In 2025, the market for bio-based hydraulic fluids is anticipated to grow by approximately 15%, driven by regulatory pressures and consumer preferences for sustainable products. This shift towards innovative formulations indicates a transformative phase for the Hydraulic Fluid Market, as manufacturers strive to meet evolving standards and customer expectations.

Regulatory Compliance and Environmental Standards

The Hydraulic Fluid Market is significantly influenced by regulatory compliance and environmental standards. Governments worldwide are implementing stringent regulations regarding the use and disposal of hydraulic fluids, pushing manufacturers to develop eco-friendly alternatives. In 2025, compliance with these regulations is expected to drive a shift towards biodegradable and less toxic hydraulic fluids, potentially increasing their market share by 20%. This trend not only reflects a growing awareness of environmental issues but also presents opportunities for companies to innovate and differentiate their products in the Hydraulic Fluid Market.