Research Methodology on Syngas Market

Introduction

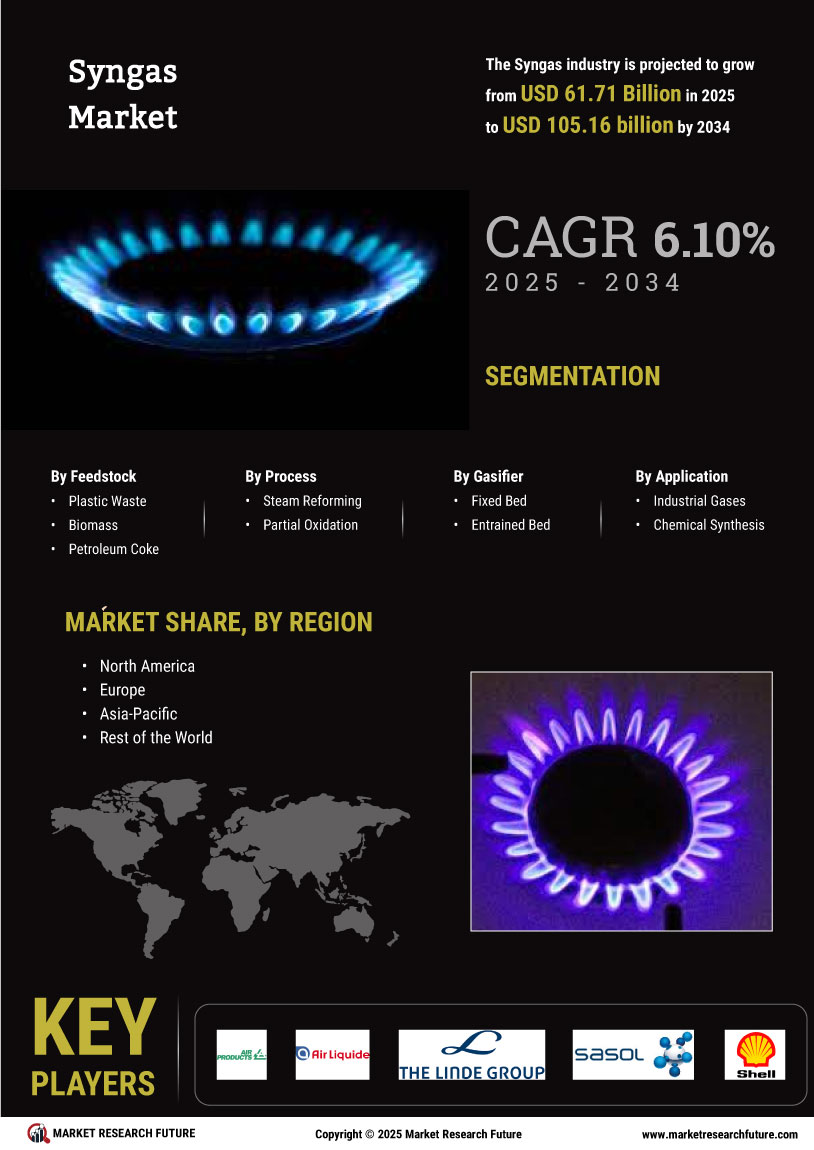

Syngas is a term used to denote a fuel gas which is composed primarily of hydrogen (H2) and carbon monoxide (CO). It is produced from molecules which contain various sources such as coal, natural gas, petroleum, biomass, solid wastes and other organic or inorganic materials. The production of syngas is done by the process of many thermochemical processes including biomass gasification and steam reforming of natural gas, partial oxidation of coal and other hydrocarbons, and indirect liquefaction processes. The syngas is used as a precursor in the petrochemical industry, it is also used as a feedstock in ammonia and methanol production as well as liquid fuel synthesis. Moreover, syngas is extensively used as a fuel, a coolant and in manufacturing numerous products.

Research aim and objectives

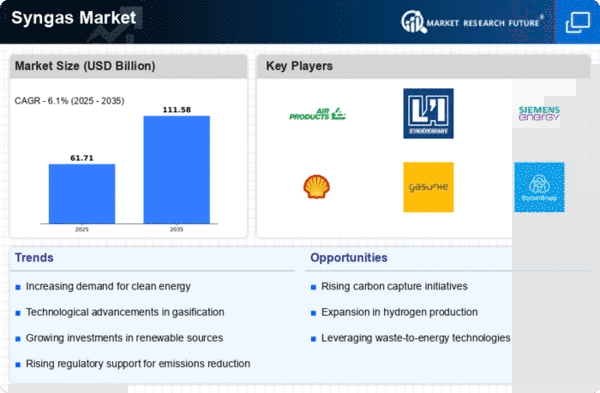

This research aims to review the global Syngas market growth, with an emphasis on production, consumption, regional and global trends, technological advancements, and market Forecasts from 2023 to 2030. The research also includes technology evaluation, production, and demand for the market.

Research Objectives

- To provide insights into the global Syngas market 2023-2030.

- To evaluate the global Syngas market and its various sub-segments.

- To provide a comprehensive analysis of market dynamics such as drivers, restraints, opportunities, and challenges for the Syngas market.

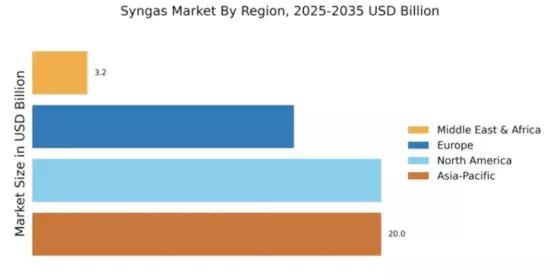

- To assess the regional and global market trends in detail.

- To evaluate the production and demand of Syngas in different regions.

- To gain an understanding of the technological advancements in the Syngas market.

- To identify and analyze key market players and their strategies such as mergers and acquisitions, collaborations, partnerships, and joint ventures.

Research Methodology

The research methodology adopted for the present study is a combination of qualitative and quantitative research.

Data Collection

The research data is gathered from secondary sources such as industry associations, annual reports, market research reports, interviews, and case studies. The secondary data is collected from reliable sources such as publications in scientific journals, white papers, government reports and other sources. The primary data is collected from interviews with industry experts from the Syngas market.

Data Analysis

The data collected from various sources is been analyzed using the statistical technique of econometrics. The data analysis process involves analysing the data with the help of statistical techniques such as correlation analysis, regression analysis, trend analysis, principal component analysis, ANOVA and analysis of variance. The results of these analysis techniques are presented in a graphical format.

Forecasting

The forecasting process involves modelling the data to identify future trends and patterns. The modelling process includes the application of machine learning techniques such as artificial neural networks and regression analysis. The forecasted data is then analysed using the aforementioned techniques.

Conclusion

The research provides insights into the trends and opportunities in the global Syngas market for the forecast period 2023-2030. The research provides an in-depth analysis of the Syngas market across regions and countries. The research also provides a detailed analysis of the production and demand of Syngas in different regions. Moreover, the research provides a clear understanding of the technological advancements in the Syngas market. Finally, the research identifies and analyses key market players and their strategies such as mergers and acquisitions, collaborations, partnerships, and joint ventures.