China Syngas Market Summary

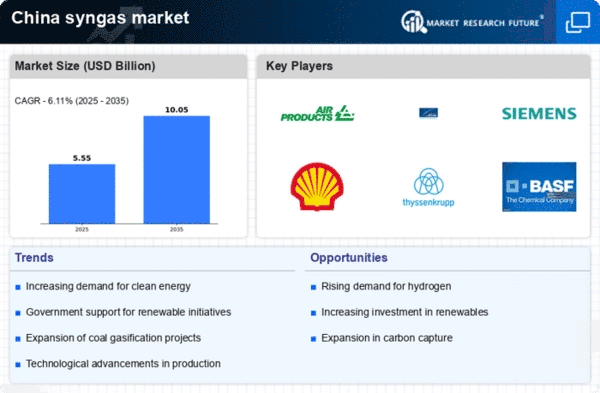

As per Market Research Future analysis, the China syngas market Size was estimated at 5.23 USD Billion in 2024. The China syngas market is projected to grow from 5.55 USD Billion in 2025 to 10.05 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 6.1% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The China syngas market is poised for growth driven by technological advancements and regulatory support for cleaner energy solutions.

- Technological advancements in production processes are enhancing efficiency and reducing costs in the syngas market.

- The largest segment in the China syngas market is the industrial applications sector, which is experiencing robust growth.

- Regulatory support for cleaner energy solutions is fostering a favorable environment for syngas adoption.

- Rising energy demand and government initiatives for clean energy are key drivers propelling the market forward.

Market Size & Forecast

| 2024 Market Size | 5.23 (USD Billion) |

| 2035 Market Size | 10.05 (USD Billion) |

| CAGR (2025 - 2035) | 6.11% |

Major Players

Air Products and Chemicals Inc (US), Linde plc (IE), Siemens AG (DE), Shell Global Solutions International B.V. (NL), Thyssenkrupp AG (DE), BASF SE (DE), SABIC (SA), Mitsubishi Heavy Industries Ltd (JP), KBR Inc (US)