Research Methodology on Surgical Drapes and Gowns Market

Introduction

Surgical drapes and gowns are protective clothing components used by medical professionals and surgeons during surgical procedures. They are used to keep the surgical area sterile and to protect both patients and healthcare personnel from infections. These products are highly critical in protecting against infection and cross-contamination in the operating theatre. This market research report presents a comprehensive outlook on the global surgical drapes and gowns market by assessing the market size, competitive landscape, and key drivers, opportunities, and challenges. It provides a detailed analysis for the 2023–2030 period for emerging & established markets.

Research Methodology

To understand the market for surgical drapes and gowns, the research used a diverse set of techniques designed to provide an in-depth understanding. The methodological approach involved the following activities:

- Literature review – The research team conducted a comprehensive literature review that covered studies on the global surgical drapes and gowns market. This included information from journals, online databases, and industry magazines and websites.

- Primary research – The research team conducted interviews with stakeholders, such as medical professionals, surgical product manufacturers, and government agencies. These interviews helped them to validate the research data obtained from the literature review.

- Secondary research – The research team used several sources such as market reports, industry databases, and company presentations. These sources provided data on the global market, historical data, key drivers, challenges, opportunities, and detailed market insights.

- Forecasting – The research team applied advanced forecasting models to generate future estimates for the 2023–2030 period. The models used for this purpose were revenue, volume, and market share models.

- Analysis – The research team then used advanced statistical tools and qualitative/quantitative analysis techniques to generate meaningful insights from the data.

- Validation – The research team used the Delphi method and triangulation to validate the data obtained for this research.

Data Sources

The primary and secondary sources used for this research include:

- Primary sources – Healthcare professionals, surgical product manufacturers and government agencies

- Secondary sources – Market reports, industry databases, and company presentations

Research Variables

The following variables were used in the analysis of the global surgical drapes and gowns market:

- Market size and growth rate

- Drivers and challenges

- Product types and segments

- Technology trends and developments

- Regional market trends

- Regulations and standards

- Competitive landscape

- Emerging trends and opportunities

Market Segmentation

The global surgical drapes and gowns market was segmented on the basis of:

- Product type – Disposable drapes, reusable drapes and gowns.

- End-user – Hospitals, ambulatory surgery centres, speciality clinics and others.

- Applications – Orthopedic surgeries, emergency procedures, neurological surgeries, oncology surgeries and others.

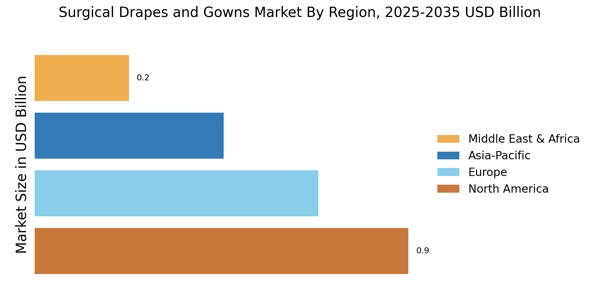

- Geography – North America, Europe, Asia-Pacific, Latin America and Middle East & Africa.

Sampling

The research is based on a cross-sectional, global sample of healthcare professionals, surgical product manufacturers and government agencies. The sample is selected to represent key markets and to allow for a comprehensive analysis and forecast of the global surgical drapes and gowns market.

Data Collection and Analysis

Data is collected from both primary and secondary sources and analyzed using advanced statistical tools such as regression and principal component analysis. Qualitative/quantitative analysis techniques were used to generate meaningful insights from the data.

Quality Control and Usage Limits

The data collected for this research is checked for accuracy by the research team and verified using the Delphi method and triangulation. All data is used in accordance with the usage limits defined in the terms of use and following the research objectives.

Expected Results

The research is expected to provide the following results:

A comprehensive analysis of the global surgical drapes and gowns market

Detailed insights into the market size, drivers, challenges, and opportunities

Detailed analysis of product types, applications, and end-users

An in-depth analysis of the competitive landscape

Comprehensive analysis of regional markets

Insightful analysis of technology trends and developments

Accurate forecasts for the 2023–2030 period