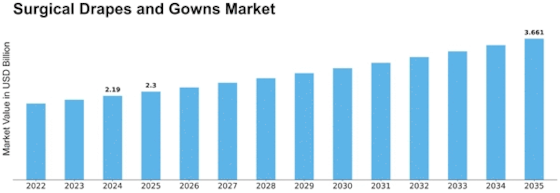

Surgical Drapes And Gowns Size

Surgical Drapes and Gowns Market Growth Projections and Opportunities

The floating wind turbine market is a problem due to a myriad of marketplace factors that drastically affect its growth and improvement. One outstanding issue contributing to the expansion of this market is the increasing worldwide demand for renewable strength sources. As nations attempt to lessen their reliance on fossil fuels and mitigate the impact of weather exchange, the focal point on harnessing wind energy has intensified. Floating wind turbines, able to tap into effective offshore winds, become a viable and efficient solution, assembly the escalating demand for easy strength. The geographical distribution of appropriate offshore wind resources plays a pivotal role in shaping the floating wind turbine market. Regions with expansive coastlines and deep waters, where conventional constant-bottom turbines might not be viable, present a great environment for floating wind farms. Countries with a strategic cognizance of offshore wind strength, including those in Northern Europe and components of Asia, are driving the market ahead by means of leveraging their favorable geographical situations for floating wind turbine installations. The financial feasibility of floating wind turbines is another key market thing. As the fee of generation continues to lower and economies of scale are realized, floating wind turbines grow to be more economically feasible. The reduction in the levelized cost of energy (LCOE) associated with floating wind projects makes them increasingly more attractive to buyers and strength developers, contributing to the marketplace's expansion. Environmental issues and the commitment to sustainability are using forces inside the Floating wind turbine Market. The offshore nature of those mills minimizes visual and noise impacts on coastal landscapes, addressing some of the environmentally demanding situations associated with onshore wind projects. Additionally, the clean and renewable nature of wind electricity aligns with international efforts to transition to more sustainable and eco-friendly energy assets. Supply chain dynamics and industry collaborations are also shaping the Floating wind turbine Market. As the marketplace matures, collaborations between turbine manufacturers, mission developers, and engineering firms come to be crucial for the hit deployment of floating wind tasks. The marketplace isn't always proof against challenges, and factors such as technical uncertainties, project financing, and regulatory complexities can impede growth. However, ongoing studies, technological advancements, and collaborative efforts inside the industry are actively addressing these challenges, paving the way for a stronger and more resilient floating wind turbine market. In the end, the Floating wind turbine Market is stimulated with the aid of a complicated interplay of things, together with international demand for renewable energy, technological improvements, favorable geographical situations, government policies, financial feasibility, environmental concerns, and industry collaborations.

Leave a Comment