Expansion in Medical Applications

The Sulfone Polymer Market is witnessing an expansion in its applications within the medical field. Sulfone polymers are increasingly being used in medical devices, including surgical instruments, drug delivery systems, and diagnostic equipment, due to their biocompatibility and resistance to sterilization processes. The medical device market is expected to grow at a CAGR of approximately 6% in the coming years, driven by advancements in healthcare technology and an aging population. This trend suggests a robust opportunity for sulfone polymers, as manufacturers prioritize materials that ensure safety and efficacy in medical applications. The unique properties of sulfone polymers, such as their ability to maintain structural integrity under various conditions, make them a preferred choice in the Sulfone Polymer Market.

Innovations in Recycling Technologies

The Sulfone Polymer Market is likely to benefit from innovations in recycling technologies that enhance the sustainability of polymer materials. As environmental concerns continue to rise, the demand for recyclable materials is becoming increasingly important. Recent advancements in recycling processes for sulfone polymers may enable manufacturers to reclaim and reuse these materials, thereby reducing waste and promoting a circular economy. This shift towards sustainability is expected to influence purchasing decisions across various industries, as companies seek to align with eco-friendly practices. The potential for recycling sulfone polymers could open new avenues for growth within the Sulfone Polymer Market, as it addresses both environmental and economic considerations.

Increasing Applications in Electronics

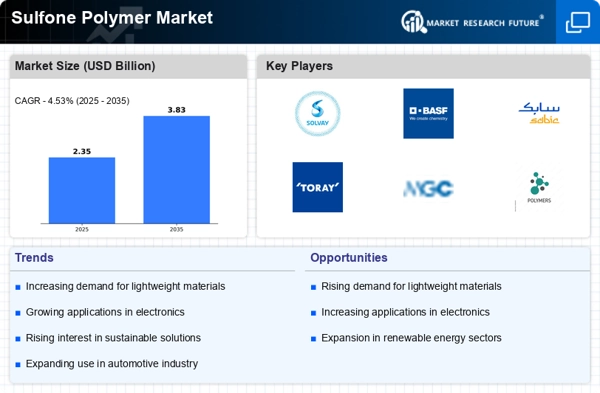

The Sulfone Polymer Market is experiencing a notable surge in demand due to its increasing applications in the electronics sector. Sulfone polymers, known for their excellent thermal stability and electrical insulation properties, are being utilized in various electronic components, including connectors, circuit boards, and insulators. The market for electronic components is projected to grow significantly, with estimates suggesting a compound annual growth rate (CAGR) of around 5% over the next few years. This growth is likely to drive the demand for sulfone polymers, as manufacturers seek materials that can withstand high temperatures and provide reliable performance. As the electronics industry continues to innovate, the Sulfone Polymer Market is poised to benefit from the rising need for advanced materials that meet stringent performance criteria.

Rising Demand for High-Performance Materials

The Sulfone Polymer Market is benefiting from the rising demand for high-performance materials across various sectors. Industries such as aerospace, automotive, and telecommunications are increasingly seeking materials that can withstand extreme conditions while maintaining performance. Sulfone polymers, with their superior mechanical properties and chemical resistance, are well-suited for these applications. The aerospace sector, in particular, is projected to grow at a CAGR of around 4% as manufacturers look for lightweight and durable materials to enhance fuel efficiency and reduce emissions. This trend indicates a growing reliance on sulfone polymers, positioning the Sulfone Polymer Market favorably in the context of high-performance material requirements.

Growth in Construction and Infrastructure Development

The Sulfone Polymer Market is poised for growth due to the increasing investments in construction and infrastructure development. Sulfone polymers are utilized in various construction applications, including piping systems, insulation materials, and structural components, owing to their durability and resistance to harsh environmental conditions. The construction industry is anticipated to grow at a CAGR of approximately 5% in the upcoming years, driven by urbanization and infrastructure projects. This growth is likely to create a heightened demand for sulfone polymers, as builders and contractors seek materials that offer longevity and performance. Consequently, the Sulfone Polymer Market stands to gain from the expanding construction sector, which emphasizes the need for reliable and high-quality materials.