Consumer Awareness

The rising awareness among consumers regarding environmental issues is a significant driver for the Stone Paper Market. As individuals become more informed about the impact of their purchasing decisions, there is a noticeable shift towards products that are sustainable and eco-friendly. This heightened awareness is reflected in consumer preferences, with many actively seeking out stone paper products as alternatives to traditional paper. Industry expert's indicates that a substantial percentage of consumers are willing to pay a premium for sustainable products, which bodes well for the stone paper sector. This trend is likely to continue, as educational campaigns and advocacy for environmental responsibility gain traction. Consequently, the Stone Paper Market stands to benefit from this growing consumer consciousness, leading to increased demand and market expansion.

Regulatory Support

Government regulations aimed at reducing plastic waste and promoting sustainable materials are influencing the Stone Paper Market positively. Many countries are implementing policies that encourage the use of eco-friendly materials, which aligns with the properties of stone paper. For example, regulations that limit single-use plastics are creating a favorable environment for alternative materials like stone paper. This regulatory support not only enhances market visibility but also incentivizes manufacturers to invest in stone paper production. As a result, the Stone Paper Market is likely to benefit from increased funding and research initiatives aimed at improving production processes and expanding product offerings. The alignment of regulatory frameworks with sustainability goals suggests a promising future for stone paper as a viable alternative in various sectors.

Innovative Applications

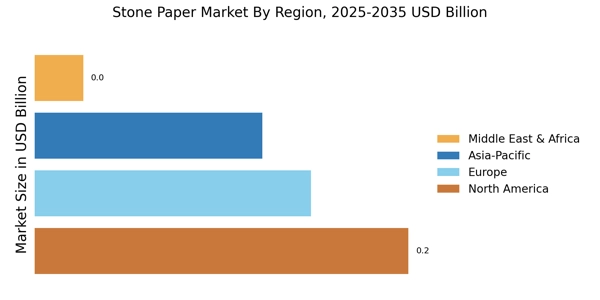

The versatility of stone paper is driving its adoption across diverse applications, thereby propelling the Stone Paper Market. This material is not limited to traditional uses such as notebooks and printing; it is increasingly being utilized in packaging, labels, and even outdoor products due to its water-resistant and tear-resistant properties. The market for stone paper packaging is projected to expand as businesses seek sustainable alternatives to plastic. For instance, the packaging sector is expected to witness a compound annual growth rate of over 10% in the coming years, indicating a robust opportunity for stone paper products. As industries explore innovative applications, the Stone Paper Market is likely to experience significant growth, driven by the material's unique characteristics and adaptability.

Sustainability Initiatives

The increasing emphasis on sustainability is a pivotal driver for the Stone Paper Market. As consumers and businesses alike become more environmentally conscious, the demand for eco-friendly alternatives to traditional paper products rises. Stone paper, made from calcium carbonate and non-toxic resins, offers a sustainable solution that reduces deforestation and water usage. In fact, the production of stone paper consumes significantly less water compared to conventional paper manufacturing. This shift towards sustainable practices is not merely a trend; it is becoming a fundamental expectation across various sectors, including packaging, stationery, and printing. Consequently, companies that prioritize sustainability in their operations are likely to gain a competitive edge in the Stone Paper Market, appealing to a growing demographic that values environmental responsibility.

Technological Advancements

Technological innovations in the production of stone paper are enhancing its market viability, thus serving as a key driver for the Stone Paper Market. Advances in manufacturing processes have led to improved efficiency and reduced costs, making stone paper more accessible to a wider range of consumers and businesses. For instance, the development of new machinery and techniques has streamlined the production process, allowing for higher output and better quality control. Additionally, ongoing research into the properties of stone paper is likely to yield new applications and improvements in performance. As technology continues to evolve, the Stone Paper Market is expected to experience growth driven by these advancements, which not only enhance product quality but also expand the potential for market penetration across various sectors.