Market Growth Projections

The Global Stoma or Ostomy Care Market Industry is projected to experience substantial growth over the coming years. With a market value of approximately 4.84 USD Billion in 2024, it is expected to reach around 7.23 USD Billion by 2035. This growth trajectory indicates a compound annual growth rate (CAGR) of 3.72% from 2025 to 2035. Such projections highlight the increasing demand for ostomy care products and services, driven by factors such as rising chronic disease prevalence and technological advancements. The market's expansion reflects a broader recognition of the importance of ostomy care in enhancing patient quality of life.

Improved Healthcare Infrastructure

The Global Stoma or Ostomy Care Market Industry is also benefiting from improvements in healthcare infrastructure across various regions. Enhanced access to healthcare services, particularly in developing countries, is facilitating timely diagnosis and treatment of conditions requiring ostomy care. Investments in healthcare facilities and training for healthcare professionals are crucial in ensuring that patients receive appropriate care. As healthcare systems evolve, the demand for ostomy products is likely to increase, contributing to market growth. This trend is particularly relevant as countries strive to meet the healthcare needs of their populations, thereby expanding the market for ostomy care.

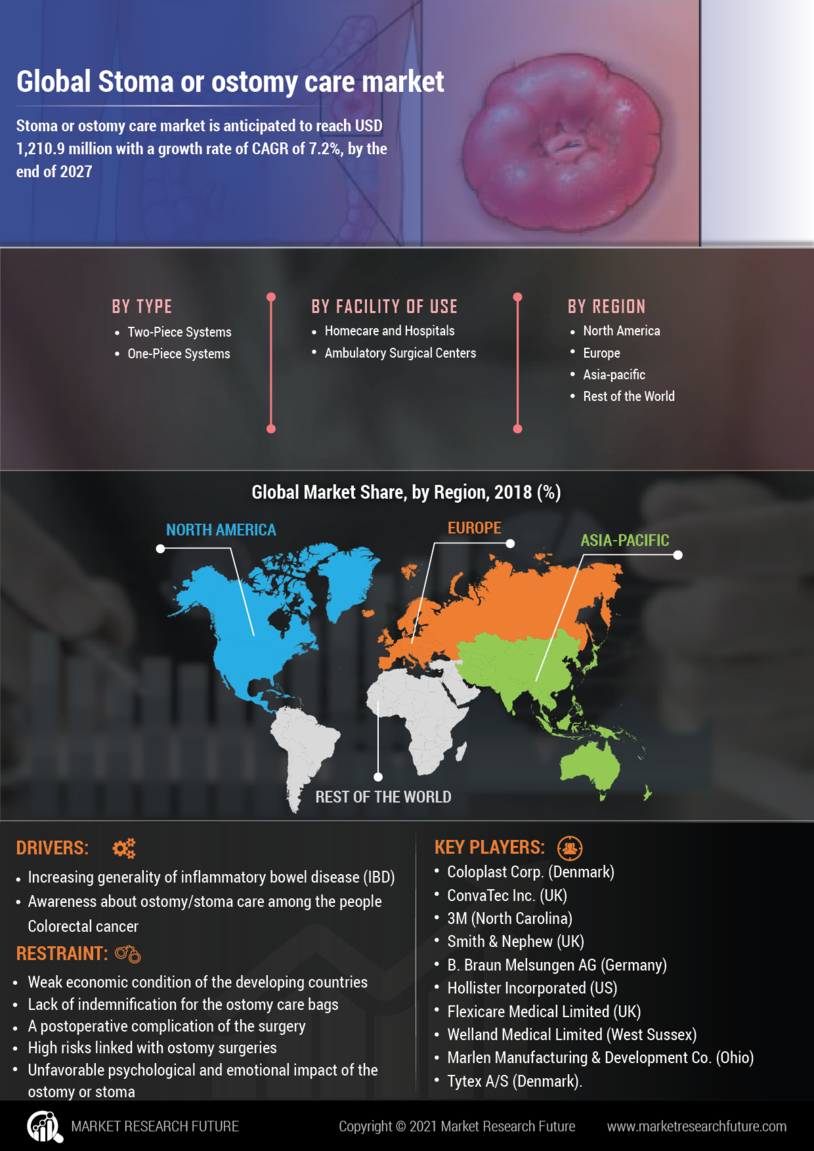

Rising Prevalence of Chronic Diseases

The Global Stoma or Ostomy Care Market Industry is witnessing growth driven by the increasing prevalence of chronic diseases such as colorectal cancer, inflammatory bowel disease, and diabetes. These conditions often necessitate surgical interventions that result in stoma creation. For instance, colorectal cancer cases are projected to rise, leading to a higher demand for ostomy products. As of 2024, the market is valued at approximately 4.84 USD Billion, reflecting the urgent need for effective stoma care solutions. This trend is expected to continue, with the market projected to reach 7.23 USD Billion by 2035, indicating a growing patient population requiring specialized care.

Growing Awareness and Education Programs

The Global Stoma or Ostomy Care Market Industry benefits from enhanced awareness and education initiatives aimed at patients and healthcare professionals. Organizations and advocacy groups are actively promoting knowledge about ostomy care, which helps to reduce stigma and improve the quality of life for individuals with stomas. Educational programs often provide critical information on product usage, skin care, and lifestyle adjustments. As awareness increases, more patients are likely to seek ostomy solutions, thereby expanding the market. This trend is crucial in ensuring that patients receive adequate support and resources, ultimately contributing to market growth.

Technological Advancements in Ostomy Products

Innovations in ostomy care products are significantly influencing the Global Stoma or Ostomy Care Market Industry. Manufacturers are increasingly focusing on developing advanced products that enhance patient comfort and quality of life. For example, the introduction of skin-friendly adhesives and odor-control technologies has improved user satisfaction. These advancements not only cater to the needs of patients but also align with healthcare providers' goals of optimizing care. The anticipated compound annual growth rate (CAGR) of 3.72% from 2025 to 2035 underscores the potential for continued investment in research and development, further driving market expansion.

Aging Population and Increased Surgical Procedures

The demographic shift towards an aging population is a pivotal driver for the Global Stoma or Ostomy Care Market Industry. Older adults are more susceptible to conditions that require ostomy surgeries, such as cancer and diverticulitis. As the global population ages, the demand for surgical procedures that result in stomas is expected to rise. This demographic trend is compounded by advancements in surgical techniques, making procedures safer and more accessible. Consequently, the market is poised for growth, with projections indicating a value of 7.23 USD Billion by 2035, reflecting the increasing need for ostomy care solutions among older adults.