Rising Incidence of Chronic Diseases

The increasing prevalence of chronic diseases in Germany, such as colorectal cancer and inflammatory bowel disease, is a primary driver of the Germany stoma ostomy care market. According to recent health statistics, approximately 30,000 new cases of colorectal cancer are diagnosed annually in Germany, leading to a higher demand for ostomy procedures. This trend suggests that as more individuals undergo ostomy surgeries, the need for specialized care products and services will likely rise. Furthermore, the aging population, which is projected to reach 22 million individuals aged 65 and older by 2030, may further exacerbate this demand. Consequently, healthcare providers and manufacturers are focusing on developing innovative ostomy care solutions to cater to this growing patient demographic.

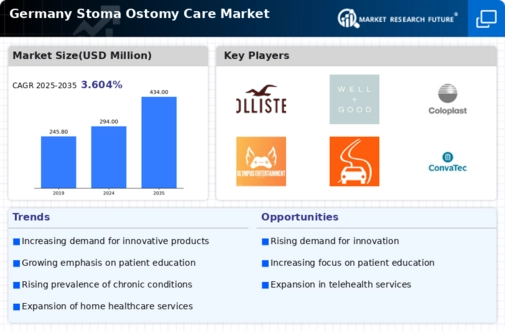

Expansion of Home Healthcare Services

The expansion of home healthcare services is significantly influencing the Germany stoma ostomy care market. As the healthcare landscape shifts towards more patient-centered care, many ostomy patients prefer receiving care in the comfort of their homes. This trend is supported by the increasing availability of home healthcare providers who specialize in ostomy care management. According to recent data, the home healthcare market in Germany is expected to grow at a compound annual growth rate of 8% over the next five years. This growth is likely to enhance the accessibility of ostomy care products and services, as home healthcare providers often collaborate with manufacturers to ensure patients receive the necessary supplies and support.

Growing Awareness and Education Initiatives

The increasing awareness and education initiatives surrounding ostomy care are pivotal in the Germany stoma ostomy care market. Healthcare organizations and patient advocacy groups are actively promoting education programs that inform patients about ostomy management and available products. This heightened awareness is crucial, as it empowers patients to make informed decisions regarding their care. Furthermore, educational workshops and seminars are being organized to address common concerns and misconceptions about living with an ostomy. As a result, patients are more likely to seek out necessary products and services, thereby driving demand within the market. This trend indicates a positive shift towards improved patient engagement and self-management.

Technological Innovations in Ostomy Products

Technological advancements in ostomy care products are transforming the Germany stoma ostomy care market. Innovations such as skin-friendly adhesives, odor-control technologies, and advanced pouch designs are enhancing the quality of life for ostomy patients. For instance, the introduction of one-piece and two-piece systems has provided patients with more options tailored to their lifestyle needs. Moreover, the integration of digital health solutions, such as mobile applications for tracking ostomy care, is gaining traction among patients and healthcare providers. These advancements not only improve patient satisfaction but also drive market growth as manufacturers strive to meet the evolving demands of consumers.

Government Support and Reimbursement Policies

Government initiatives and reimbursement policies play a crucial role in shaping the Germany stoma ostomy care market. The German healthcare system provides comprehensive coverage for ostomy care products, which encourages patients to seek necessary treatments without financial burden. The statutory health insurance system covers a significant portion of ostomy supplies, ensuring accessibility for patients. Additionally, recent reforms aimed at improving the quality of care for ostomy patients have led to increased funding for specialized services. This supportive regulatory environment not only enhances patient outcomes but also stimulates market growth by attracting manufacturers to invest in the development of advanced ostomy care products.