Growing Awareness and Education

Increasing awareness and education surrounding stoma care are driving factors in the UK stoma ostomy care market. Healthcare professionals are placing greater emphasis on educating patients about ostomy management, which is crucial for improving patient outcomes. Initiatives such as workshops, seminars, and online resources are being implemented to provide patients with the knowledge and skills necessary for effective self-management. Market data suggests that patient education programs have led to a 30% increase in patient satisfaction and adherence to care regimens. Furthermore, advocacy groups are actively working to destigmatize ostomy care, fostering a more supportive environment for individuals living with a stoma. This heightened awareness is likely to result in increased demand for ostomy products and services, thereby propelling the growth of the UK stoma ostomy care market.

Advancements in Product Technology

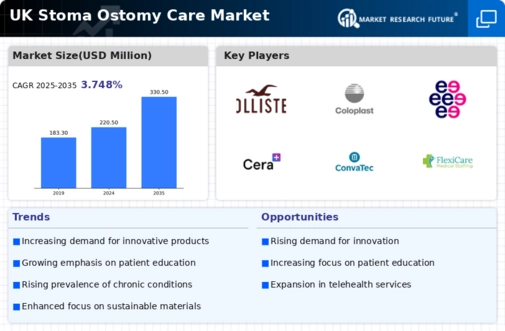

Technological advancements play a pivotal role in shaping the UK stoma ostomy care market. Innovations in product design, materials, and functionality have led to the development of more effective and user-friendly ostomy appliances. For instance, the introduction of skin-friendly adhesives and odor-control technologies has significantly improved the quality of life for ostomy patients. Market data indicates that the demand for advanced ostomy products is expected to grow at a compound annual growth rate (CAGR) of 5.2% over the next five years. This growth is driven by the increasing awareness of the benefits of modern ostomy care solutions among healthcare professionals and patients alike. As manufacturers continue to invest in research and development, the UK stoma ostomy care market is likely to witness a surge in innovative products that enhance patient comfort and satisfaction.

Focus on Personalized Care Solutions

The UK stoma ostomy care market is witnessing a shift towards personalized care solutions that cater to the unique needs of individual patients. As healthcare providers recognize the importance of tailored approaches, there is a growing emphasis on customizing ostomy products to enhance patient comfort and functionality. This trend is supported by market data indicating that personalized ostomy care solutions can lead to improved patient outcomes and satisfaction. For instance, the development of bespoke ostomy appliances that consider factors such as body shape, lifestyle, and skin sensitivity is becoming increasingly prevalent. Additionally, healthcare professionals are adopting a more holistic approach to stoma care, incorporating psychological support and lifestyle counseling into treatment plans. This focus on personalized care is likely to drive innovation and growth within the UK stoma ostomy care market.

Rising Prevalence of Chronic Conditions

The UK stoma ostomy care market is experiencing growth due to the increasing prevalence of chronic conditions such as colorectal cancer, inflammatory bowel disease, and diverticulitis. According to recent statistics, the incidence of colorectal cancer in the UK has been on the rise, with approximately 42,000 new cases diagnosed annually. This trend necessitates a greater demand for ostomy care products and services, as patients require ongoing management and support. Furthermore, the aging population in the UK, which is projected to reach 23 million individuals aged 65 and over by 2030, is likely to contribute to the growing need for stoma care solutions. As a result, healthcare providers and manufacturers are focusing on developing innovative products tailored to meet the specific needs of this demographic, thereby driving the UK stoma ostomy care market.

Government Support and Healthcare Policies

The UK stoma ostomy care market benefits from supportive government policies and healthcare initiatives aimed at improving patient outcomes. The National Health Service (NHS) has implemented various programs to ensure that ostomy patients receive adequate care and access to necessary products. For example, the NHS provides funding for ostomy appliances and accessories, which alleviates the financial burden on patients. Additionally, the UK government has established guidelines for stoma care, emphasizing the importance of personalized care plans and patient education. These initiatives not only enhance the quality of care but also promote awareness of ostomy issues within the healthcare community. As a result, the UK stoma ostomy care market is likely to experience growth as more patients are encouraged to seek treatment and support.