Innovations in Packaging Technology

Technological advancements play a pivotal role in shaping the Stock Clamshell Packaging Market. Innovations in materials and manufacturing processes are leading to the development of more efficient and sustainable clamshell packaging solutions. For instance, the introduction of biodegradable materials and advanced sealing techniques enhances the functionality and environmental appeal of clamshells. Furthermore, automation in production lines is reducing costs and increasing output, which is essential for meeting the growing demand. As companies strive to differentiate their products, the integration of smart packaging technologies, such as QR codes and NFC tags, is also becoming prevalent. This evolution suggests that the Stock Clamshell Packaging Market will continue to adapt and thrive in response to technological progress.

Growth in Retail and E-commerce Sectors

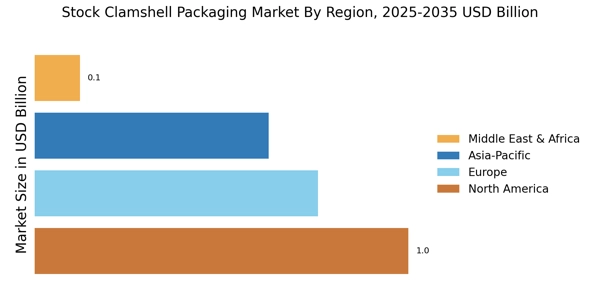

The Stock Clamshell Packaging Market is significantly influenced by the expansion of retail and e-commerce sectors. As online shopping continues to gain traction, the need for effective packaging solutions that ensure product safety during transit becomes critical. Clamshell packaging, known for its durability and protective qualities, is increasingly adopted by e-commerce businesses to minimize damage during shipping. Recent data suggests that the e-commerce sector has seen a growth rate of over 15% in the past year, which correlates with a rising demand for clamshell packaging. This trend indicates that as more retailers transition to online platforms, the Stock Clamshell Packaging Market is poised for substantial growth.

Rising Demand for Convenience Packaging

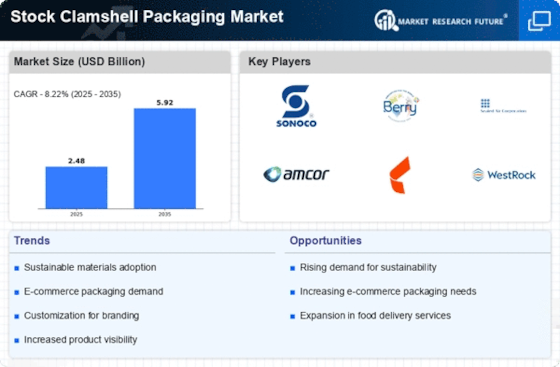

The Stock Clamshell Packaging Market is experiencing a notable increase in demand for convenience packaging solutions. As consumers increasingly seek products that are easy to use and transport, clamshell packaging offers a practical solution. This type of packaging is particularly favored in sectors such as food, electronics, and retail, where quick access and visibility are paramount. The convenience factor is further amplified by the rise of on-the-go lifestyles, leading to a projected growth rate of approximately 5% annually in the packaging sector. This trend indicates that manufacturers are likely to invest more in clamshell designs that enhance user experience, thereby driving the Stock Clamshell Packaging Market forward.

Consumer Preference for Eco-friendly Packaging

The Stock Clamshell Packaging Market is increasingly shaped by consumer preferences leaning towards eco-friendly packaging solutions. As awareness of environmental issues rises, consumers are more inclined to choose products packaged in sustainable materials. This shift is prompting manufacturers to explore alternatives to traditional plastics, such as recycled and biodegradable options. Recent surveys indicate that over 70% of consumers are willing to pay a premium for eco-friendly packaging, which is likely to influence purchasing decisions. Consequently, companies within the Stock Clamshell Packaging Market are investing in research and development to create sustainable clamshell designs that align with consumer values, thereby enhancing market competitiveness.

Regulatory Pressures for Sustainable Practices

The Stock Clamshell Packaging Market is also affected by increasing regulatory pressures aimed at promoting sustainable practices. Governments and regulatory bodies are implementing stricter guidelines regarding packaging waste and material usage, compelling manufacturers to adopt more environmentally responsible approaches. These regulations often encourage the use of recyclable and compostable materials in packaging solutions. As a result, companies are re-evaluating their packaging strategies to comply with these regulations while maintaining product integrity. This trend suggests that the Stock Clamshell Packaging Market will likely see a shift towards more sustainable practices, which could redefine packaging standards in the coming years.