Rising Environmental Awareness

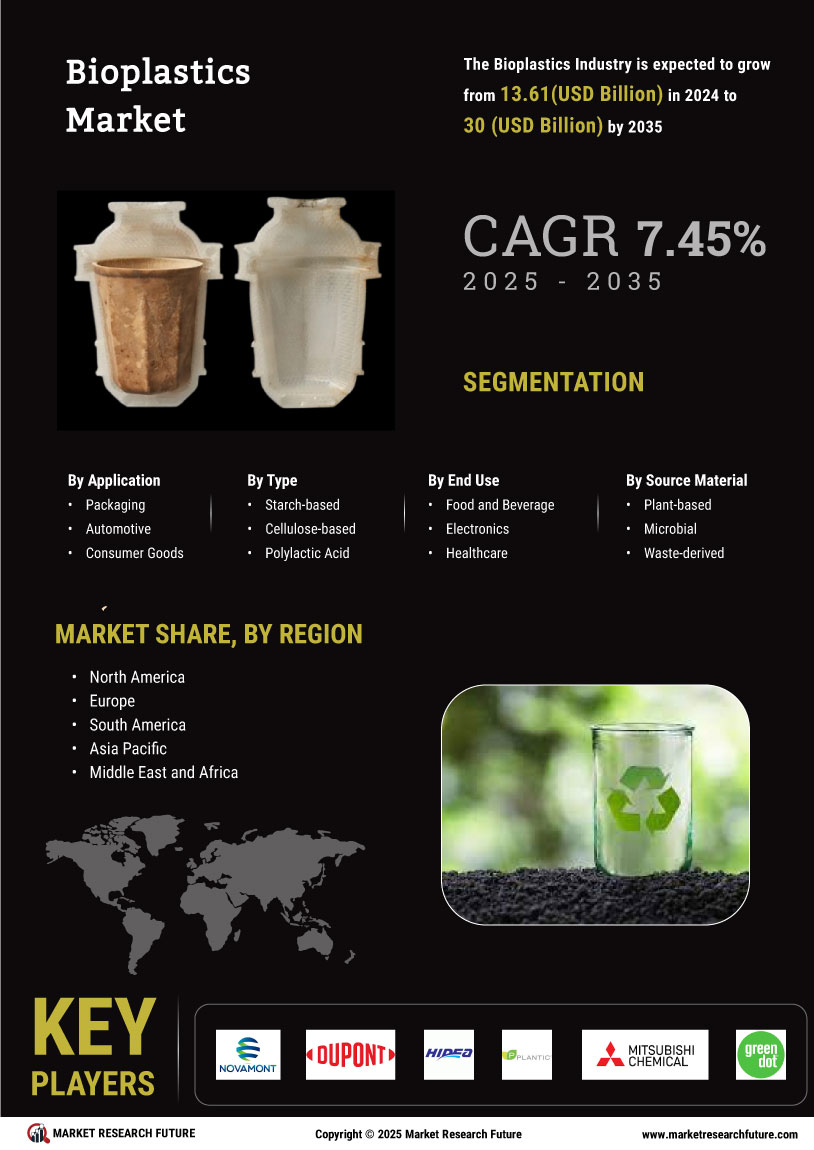

The increasing awareness regarding environmental issues is a pivotal driver for the Bioplastics Market. Consumers are becoming more conscious of the ecological impact of traditional plastics, leading to a surge in demand for sustainable alternatives. This shift in consumer behavior is reflected in market data, which indicates that the bioplastics segment is projected to grow at a compound annual growth rate of approximately 15% over the next five years. Companies are responding by investing in bioplastics production, aiming to meet the rising demand for eco-friendly products. As a result, the Bioplastics Market is witnessing a transformation, with more brands adopting bioplastics in their packaging and product designs. This trend not only aligns with consumer preferences but also enhances brand reputation, making it a crucial factor in the industry's growth.

Innovations in Bioplastics Production

Technological advancements in bioplastics production are significantly influencing the Bioplastics Market. Innovations such as the development of new biopolymers and improved manufacturing processes are enhancing the efficiency and cost-effectiveness of bioplastics. For instance, recent breakthroughs in fermentation technology have enabled the production of bioplastics from renewable resources at a lower cost. Market data suggests that the introduction of these innovative production methods could potentially reduce the price gap between conventional plastics and bioplastics, making them more accessible to a broader range of consumers. This technological evolution is likely to drive the adoption of bioplastics across various sectors, including packaging, automotive, and consumer goods, thereby propelling the growth of the Bioplastics Market.

Government Initiatives and Regulations

Government initiatives and regulations aimed at reducing plastic waste are playing a crucial role in shaping the Bioplastics Market. Many countries are implementing policies that encourage the use of biodegradable materials, thereby creating a favorable environment for bioplastics. For example, certain regions have introduced bans on single-use plastics, which has led to an increased demand for bioplastics as a viable alternative. Market data indicates that regions with stringent regulations are experiencing a faster adoption of bioplastics, as companies seek to comply with these laws. This regulatory support not only boosts the market for bioplastics but also encourages innovation and investment in sustainable materials, further solidifying the Bioplastics Market's position in the materials landscape.

Consumer Demand for Sustainable Products

The growing consumer demand for sustainable products is a significant driver for the Bioplastics Market. As consumers become more environmentally conscious, they are actively seeking products that align with their values. This trend is evident in various sectors, including food packaging, where bioplastics are increasingly preferred over traditional materials. Market data reveals that the demand for bioplastics in packaging applications is expected to rise substantially, driven by consumer preferences for eco-friendly options. Companies are responding by incorporating bioplastics into their product lines, thereby enhancing their market competitiveness. This shift not only meets consumer expectations but also contributes to the overall growth of the Bioplastics Market, as more businesses recognize the importance of sustainability in their operations.

Collaboration and Partnerships in the Industry

Collaboration and partnerships among stakeholders in the Bioplastics Market are emerging as a vital driver for growth. Companies are increasingly joining forces with research institutions, NGOs, and other industry players to foster innovation and accelerate the development of bioplastics. These collaborations often focus on enhancing the performance and sustainability of bioplastics, which can lead to the introduction of new products and applications. Market data suggests that partnerships are instrumental in sharing knowledge and resources, thereby reducing the time and cost associated with bringing new bioplastic products to market. This collaborative approach not only strengthens the Bioplastics Market but also promotes a more integrated and sustainable supply chain, ultimately benefiting all stakeholders involved.