Spray Adhesive Size

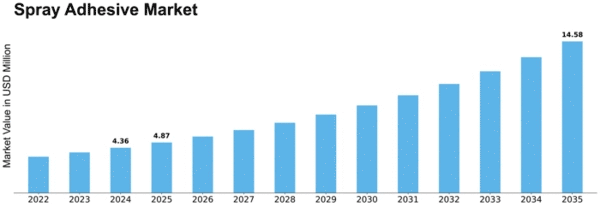

Spray Adhesive Market Growth Projections and Opportunities

The Spray Adhesive Industry which is greatly affected by numerous diverse causes that consequently determine its path and growth. One of the main factors is the rising needs of the automotive and construction industries' fast and strong bonding processes. Spray adhesives used in these industries offer enough versatility and convenience to the users who are manifoldy responsible for the growth of the market. With greater production of construction projects and automotive industries occurring all over the world, the need for reliable and instant bonding solutions keeps growing, directly affecting spray adhesive market.

Most importantly consumer trends and their favorites that directly influence the Spray Adhesive Market. Consumers are constantly seeking out solutions that reduces their own carbon footprint. With the increasing awareness of sustainability in the consumers, there is a growing trend for the environment friendly and low VOC (scentless) spray adhesives. The manufacturers create products which consumers demand that meet environment standards by developing formulations that exhibit good adhesion properties. Their emphasis on sustainability is consistent with rule-making initiatives which in turn has a potential impact on the market.

The efficient and economical bonding is the main market trend in the packaging industry, which has a big impact on the spray adhesive market. As the packaging sector transforms with the advent of e-commerce and the adoption of sustainable packaging principles, the application of spray adhesives in packaged goods takes centre stage. These glue adhesives are a strong material based solution for adhering of any packaging material thereby contributing to the overall productivity of the packaging process. Market growth, as a result, is something that hinges on the various improvements and needs that the industry has in terms of technology.

The general economic events impact the scope of the Spray Adhesive Market as well. Economic cycles and demand shifting influence manufacturing industries like construction, automotive, and manufacturing, in return affecting the demand for spray adhesives as well. While expansion causes construction as well as manufacturing industries to increase production, thereby, they become the main drivers of demand for bonding solutions. At the same time, while economic downturns often result in fewer construction projects and manufacturing, the industry will still be negatively affected greatly. Market participants get to keep an eye on of economic trends in order to see potential profits or loss of demand and modify their strategies as required.

Leave a Comment