Growth in Construction Activities

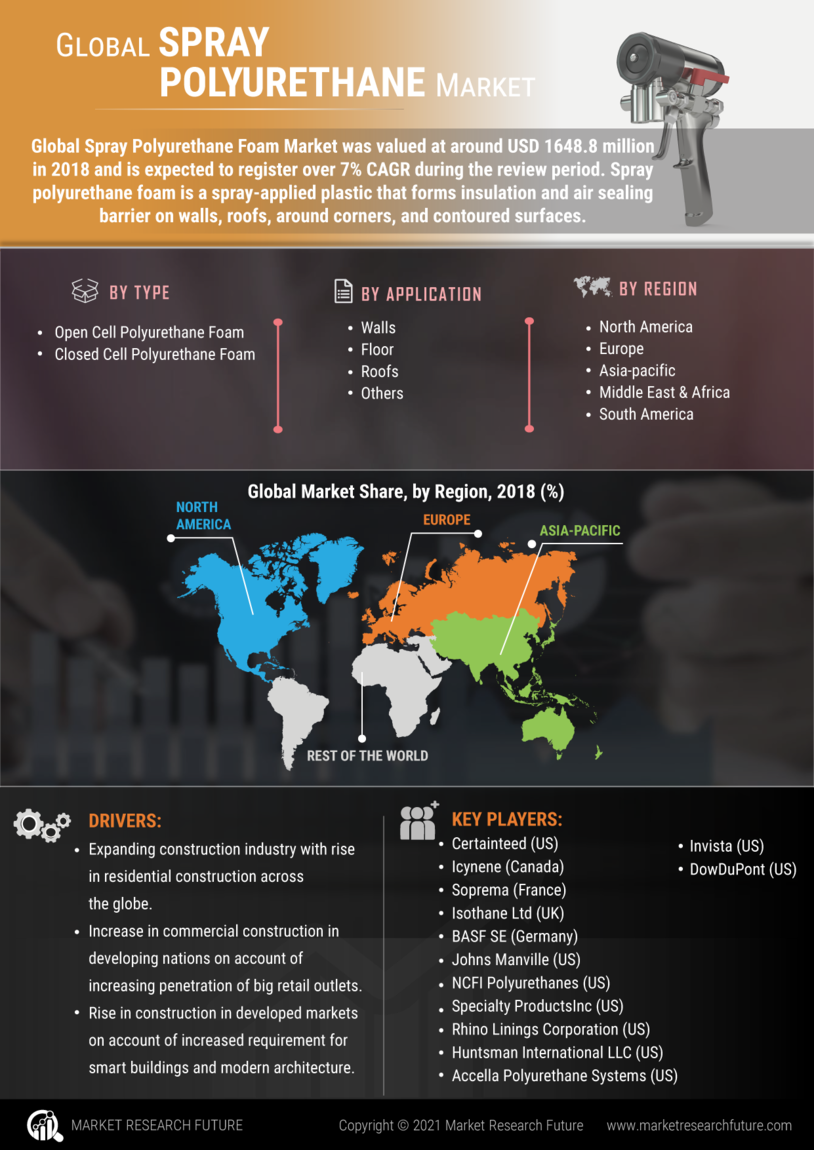

The resurgence of construction activities across various sectors seems to be a pivotal factor influencing the Spray Polyurethane Foam Market. With urbanization and infrastructure development on the rise, there is a notable increase in demand for innovative building materials. Spray polyurethane foam is favored for its versatility and ease of application, making it suitable for a range of construction projects. Recent statistics indicate that the construction sector is experiencing robust growth, which is expected to drive the demand for insulation materials, including spray foam. This growth trajectory suggests a promising outlook for the spray foam market as it aligns with the evolving needs of modern construction.

Rising Demand for Energy Efficiency

The increasing emphasis on energy efficiency in construction and renovation projects appears to be a primary driver for the Spray Polyurethane Foam Market. As energy costs continue to rise, builders and homeowners are seeking materials that provide superior insulation properties. Spray polyurethane foam offers high R-value per inch, which translates to better thermal performance. According to recent data, the insulation market is projected to grow significantly, with spray foam expected to capture a larger share due to its effectiveness in reducing energy consumption. This trend is likely to encourage more widespread adoption of spray foam solutions in both residential and commercial applications, thereby propelling the market forward.

Growing Demand for Sustainable Building Solutions

The increasing demand for sustainable building solutions is likely to significantly impact the Spray Polyurethane Foam Market. As environmental concerns gain prominence, builders and architects are actively seeking materials that contribute to sustainability goals. Spray polyurethane foam is recognized for its energy efficiency and potential to reduce carbon footprints in buildings. Recent market analyses indicate that the green building materials sector is expanding, with spray foam being a preferred choice due to its eco-friendly properties. This growing inclination towards sustainability is expected to drive innovation and investment in the spray foam market, aligning with global efforts to promote environmentally responsible construction practices.

Increased Awareness of Health and Safety Standards

The heightened awareness regarding health and safety standards in building materials is likely to bolster the Spray Polyurethane Foam Market. As consumers and builders become more informed about the potential health impacts of construction materials, there is a growing preference for products that meet stringent safety regulations. Spray polyurethane foam, when applied correctly, can contribute to healthier indoor environments by minimizing air leaks and improving air quality. Furthermore, regulatory bodies are increasingly mandating compliance with safety standards, which may drive the adoption of spray foam solutions that adhere to these guidelines. This trend indicates a shift towards safer building practices, potentially enhancing the market's growth.

Technological Innovations in Application Techniques

Technological advancements in application techniques for spray polyurethane foam are emerging as a significant driver for the Spray Polyurethane Foam Market. Innovations such as improved spray equipment and application methods are enhancing the efficiency and effectiveness of foam installation. These advancements not only reduce labor costs but also minimize waste, making the process more sustainable. As technology continues to evolve, it is likely that the market will see an increase in the adoption of spray foam solutions, particularly in complex projects where precision is crucial. This trend suggests that ongoing research and development in application technologies will play a vital role in shaping the future of the spray foam market.