Technological Advancements

Technological advancements play a pivotal role in shaping the Spain wireless network infrastructure ecosystem market. Innovations in wireless technologies, such as the development of 5G and beyond, are transforming how data is transmitted and received. The introduction of new technologies not only enhances network capacity and speed but also reduces latency, which is essential for applications like autonomous vehicles and smart cities. As Spanish companies adopt these cutting-edge technologies, the demand for modernized infrastructure is expected to rise. This shift towards advanced wireless solutions indicates a robust growth trajectory for the Spain wireless network infrastructure ecosystem market, as stakeholders seek to leverage these advancements for competitive advantage.

Focus on Smart City Initiatives

The emphasis on smart city initiatives is emerging as a key driver for the Spain wireless network infrastructure ecosystem market. Spanish cities are increasingly adopting smart technologies to improve urban living, enhance public services, and promote sustainability. These initiatives often rely on advanced wireless networks to facilitate real-time data exchange and connectivity among various city services. For example, cities like Barcelona and Madrid are implementing smart traffic management systems and public safety solutions that depend on robust wireless infrastructure. This trend not only stimulates investment in the Spain wireless network infrastructure ecosystem market but also encourages collaboration among public and private sectors to create integrated urban environments.

Increased Mobile Data Consumption

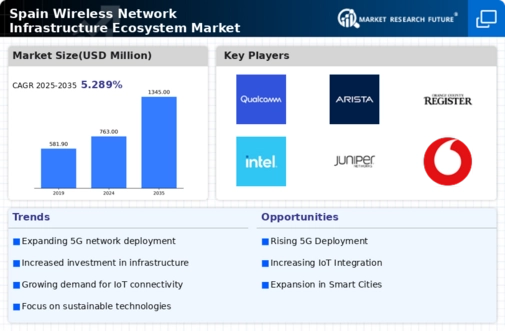

The surge in mobile data consumption is a significant driver for the Spain wireless network infrastructure ecosystem market. With the rise of streaming services, social media, and mobile applications, users are consuming more data than ever before. Reports indicate that mobile data traffic in Spain has increased by over 40% in recent years, prompting telecom operators to enhance their network capabilities. This growing demand necessitates substantial investments in wireless infrastructure to ensure that networks can handle the increased load. As a result, the Spain wireless network infrastructure ecosystem market is likely to experience accelerated growth as providers strive to meet consumer expectations for seamless connectivity.

Government Initiatives and Policies

The Spain wireless network infrastructure ecosystem market is significantly influenced by government initiatives aimed at enhancing digital connectivity. The Spanish government has implemented various policies to promote the deployment of advanced wireless technologies, including 5G. For instance, the National 5G Plan aims to ensure nationwide coverage by 2025, which is expected to drive investments in infrastructure. Additionally, the government has allocated substantial funding to support research and development in telecommunications, fostering innovation within the sector. This proactive approach not only encourages private sector participation but also enhances the overall competitiveness of the Spain wireless network infrastructure ecosystem market.

Rising Demand for High-Speed Internet

The increasing demand for high-speed internet services is a crucial driver for the Spain wireless network infrastructure ecosystem market. As more consumers and businesses seek reliable and fast connectivity, telecommunications providers are compelled to upgrade their infrastructure. According to recent data, approximately 80% of Spanish households have access to high-speed broadband, yet the demand continues to grow. This trend is further fueled by the proliferation of smart devices and the Internet of Things (IoT), which require robust wireless networks. Consequently, investments in wireless infrastructure are likely to escalate, ensuring that the Spain wireless network infrastructure ecosystem market remains dynamic and responsive to consumer needs.