Technological Advancements

Technological advancements play a pivotal role in shaping the France wireless network infrastructure ecosystem market. Innovations in network technologies, such as the development of 5G and beyond, are transforming the landscape of wireless communication. The introduction of advanced antenna systems, edge computing, and network slicing is expected to enhance the efficiency and performance of wireless networks. Furthermore, the integration of artificial intelligence and machine learning into network management systems may optimize resource allocation and improve service delivery. As these technologies continue to evolve, they are likely to drive investment in infrastructure upgrades and expansions, thereby fostering growth within the France wireless network infrastructure ecosystem market.

Rising Demand for Mobile Data

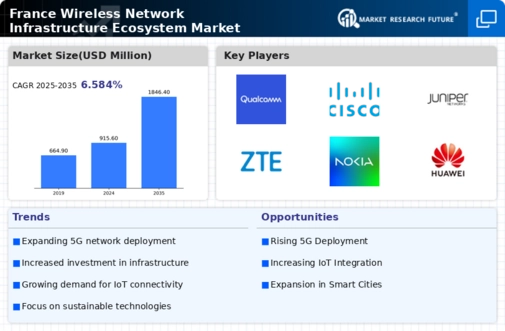

The France wireless network infrastructure ecosystem market is experiencing a surge in demand for mobile data, driven by the increasing adoption of smartphones and IoT devices. According to recent statistics, mobile data traffic in France is projected to grow by over 30% annually, necessitating the expansion of network capacity and infrastructure. This growing demand compels telecom operators to invest in advanced technologies, such as 5G, to meet consumer expectations for faster and more reliable connectivity. Consequently, the wireless network infrastructure must evolve to accommodate this influx of data traffic, which may lead to enhanced service offerings and improved user experiences. The rising demand for mobile data thus serves as a critical driver for the France wireless network infrastructure ecosystem market.

Growing Focus on Cybersecurity

As the France wireless network infrastructure ecosystem market expands, the focus on cybersecurity becomes increasingly paramount. With the proliferation of connected devices and the rise of smart cities, the potential for cyber threats escalates. Consequently, telecom operators and infrastructure providers are prioritizing the implementation of robust security measures to protect their networks and customer data. Investments in cybersecurity technologies, such as encryption and intrusion detection systems, are likely to become standard practice. This heightened emphasis on security not only safeguards the integrity of the wireless network infrastructure but also instills consumer confidence, which is essential for the continued growth of the France wireless network infrastructure ecosystem market.

Government Initiatives and Policies

The France wireless network infrastructure ecosystem market is significantly influenced by government initiatives aimed at enhancing digital connectivity. The French government has set ambitious targets for broadband coverage, with plans to invest over 20 billion euros in the rollout of high-speed internet across rural and urban areas. This investment is expected to bolster the infrastructure necessary for 5G deployment, thereby facilitating the growth of the wireless network ecosystem. Additionally, regulatory frameworks are being established to streamline the approval processes for new infrastructure projects, which may further accelerate the development of wireless networks. As a result, the proactive stance of the government appears to create a conducive environment for investment and innovation within the France wireless network infrastructure ecosystem market.

Increased Investment from Private Sector

The France wireless network infrastructure ecosystem market is witnessing a notable increase in investment from the private sector. Major telecommunications companies are committing substantial resources to enhance their network capabilities and expand coverage. For instance, leading operators have announced plans to invest billions in 5G infrastructure over the next few years, aiming to capture the growing demand for high-speed connectivity. This influx of private capital is expected to stimulate competition among service providers, leading to improved services and pricing for consumers. Additionally, partnerships between telecom companies and technology firms may further accelerate innovation within the wireless network infrastructure, indicating a robust investment climate in the France wireless network infrastructure ecosystem market.