Increased Focus on Cybersecurity

As the Japan wireless network infrastructure ecosystem market expands, there is an increasing focus on cybersecurity measures. With the rise in cyber threats and data breaches, telecommunications companies are prioritizing the security of their networks to protect sensitive information. The Japanese government has recognized the importance of cybersecurity in maintaining the integrity of its digital infrastructure and has implemented various initiatives to enhance security protocols. In 2025, the government allocated significant resources to bolster cybersecurity measures within the telecommunications sector. This heightened focus on security not only safeguards consumer data but also instills confidence in the wireless network infrastructure. As a result, investments in cybersecurity solutions are likely to grow, further driving the development of the Japan wireless network infrastructure ecosystem market.

Rising Demand for High-Speed Internet

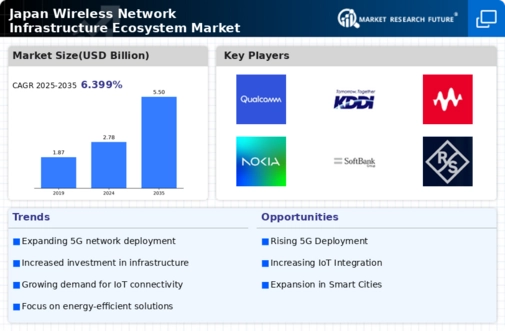

The increasing demand for high-speed internet services is a significant driver of the Japan wireless network infrastructure ecosystem market. As digital transformation accelerates across various sectors, consumers and businesses alike are seeking faster and more reliable connectivity. According to recent statistics, over 90% of Japanese households have access to high-speed internet, with a growing preference for mobile broadband solutions. This trend is further fueled by the proliferation of smart devices and the Internet of Things (IoT), which require robust network infrastructure to function effectively. Consequently, telecommunications companies are investing heavily in upgrading their wireless networks to meet this demand. The Japan wireless network infrastructure ecosystem market is thus poised for growth as service providers enhance their offerings to cater to the evolving needs of consumers and businesses.

Growth of the Internet of Things (IoT)

The rapid growth of the Internet of Things (IoT) is a pivotal driver for the Japan wireless network infrastructure ecosystem market. With millions of devices expected to be connected in the coming years, the demand for reliable and high-capacity wireless networks is surging. In Japan, the number of IoT devices is projected to reach over 1 billion by 2025, necessitating significant upgrades to existing network infrastructure. This trend is prompting telecommunications companies to invest in next-generation wireless technologies, such as 5G, which can support the massive data traffic generated by IoT applications. Additionally, the government is actively promoting IoT initiatives across various sectors, including healthcare, transportation, and manufacturing, further stimulating growth in the Japan wireless network infrastructure ecosystem market. The convergence of these factors suggests a robust future for wireless network infrastructure in Japan.

Government Support and Policy Framework

The Japan wireless network infrastructure ecosystem market benefits from robust government support and a comprehensive policy framework. The Japanese government has prioritized the development of advanced telecommunications infrastructure, particularly in the context of 5G deployment. Initiatives such as the '5G Promotion Strategy' aim to enhance connectivity across urban and rural areas, thereby fostering economic growth. In 2025, the government allocated approximately 1 trillion yen to support the expansion of wireless networks, indicating a strong commitment to this sector. This proactive approach not only encourages private investment but also ensures that Japan remains competitive in the global telecommunications landscape. The emphasis on regulatory reforms further facilitates the growth of the Japan wireless network infrastructure ecosystem market, creating a conducive environment for innovation and technological advancement.

Technological Advancements in Network Infrastructure

Technological advancements play a crucial role in shaping the Japan wireless network infrastructure ecosystem market. Innovations such as network slicing, edge computing, and advanced antenna technologies are transforming how wireless networks operate. These advancements enable more efficient use of spectrum and improve overall network performance. For instance, the introduction of Massive MIMO technology has significantly enhanced capacity and coverage in urban areas, addressing the challenges posed by high user density. Furthermore, the integration of artificial intelligence in network management is streamlining operations and reducing downtime. As these technologies continue to evolve, they are likely to drive further investment in the Japan wireless network infrastructure ecosystem market, fostering a competitive landscape that encourages continuous improvement and innovation.