Growing Geriatric Population

The aging population in Spain is a crucial driver for the sleep apnea-devices market. As individuals age, the likelihood of developing sleep apnea increases, with studies suggesting that nearly 50% of older adults may experience some form of sleep-disordered breathing. This demographic shift is prompting healthcare systems to prioritize the diagnosis and treatment of sleep apnea among seniors. Consequently, there is a rising demand for specialized devices tailored to the needs of older patients, including those with comorbidities. The sleep apnea-devices market is expected to grow as manufacturers adapt their offerings to cater to this expanding segment of the population.

Rising Prevalence of Sleep Disorders

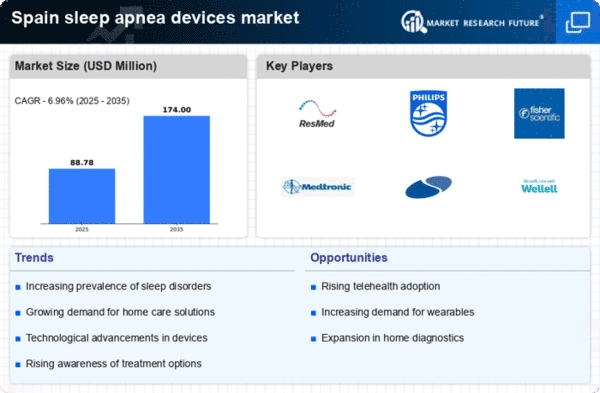

The increasing prevalence of sleep disorders in Spain is a primary driver for the sleep apnea-devices market. Recent studies indicate that approximately 4.5 million individuals in Spain suffer from sleep apnea, a condition that significantly impacts quality of life and overall health. This growing patient population necessitates the development and distribution of effective sleep apnea devices. As awareness of the health risks associated with untreated sleep apnea rises, including cardiovascular diseases and diabetes, the demand for diagnostic and therapeutic devices is expected to surge. The sleep apnea-devices market is likely to experience substantial growth as healthcare providers and patients seek solutions to manage this widespread condition.

Increased Focus on Preventive Healthcare

There is a growing emphasis on preventive healthcare in Spain, which is positively influencing the sleep apnea-devices market. Healthcare professionals are increasingly recognizing the importance of early diagnosis and intervention in managing sleep disorders. This shift towards preventive measures is leading to more comprehensive screening programs and public health campaigns aimed at educating the population about sleep apnea. As a result, more individuals are seeking diagnostic testing and treatment options, driving demand for sleep apnea devices. The sleep apnea-devices market is likely to benefit from this trend as awareness and proactive management of sleep health continue to gain traction.

Technological Innovations in Device Design

Technological innovations in the design and functionality of sleep apnea devices are significantly impacting the market. Manufacturers in Spain are increasingly focusing on developing user-friendly, portable, and effective devices that cater to the needs of patients. For instance, advancements in CPAP (Continuous Positive Airway Pressure) technology have led to quieter, more efficient machines that enhance patient compliance. The introduction of smart devices equipped with data tracking capabilities allows for better monitoring of sleep patterns and treatment efficacy. As these innovations continue to emerge, the sleep apnea-devices market is likely to expand, attracting both new users and healthcare providers seeking effective solutions.

Government Initiatives and Healthcare Policies

Government initiatives aimed at improving healthcare access and quality in Spain are influencing the sleep apnea-devices market. Recent policies have focused on enhancing the diagnosis and treatment of sleep disorders, leading to increased funding for sleep clinics and awareness campaigns. The Spanish government has allocated approximately €50 million to improve sleep health services, which is expected to facilitate the adoption of advanced sleep apnea devices. These initiatives not only promote early diagnosis but also encourage the integration of innovative technologies in treatment protocols. Consequently, the sleep apnea-devices market is poised for growth as more patients gain access to necessary care and devices.