Rising Cyber Threats

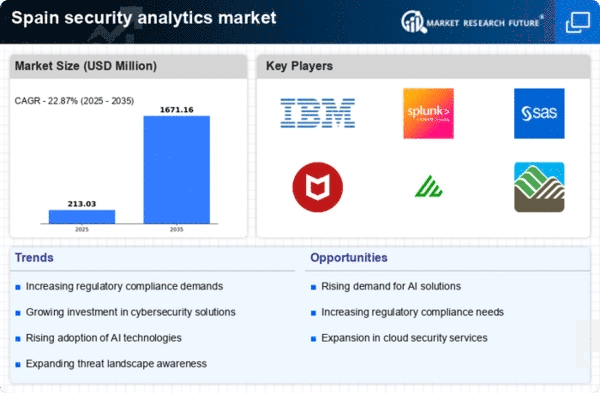

The security analytics market in Spain is experiencing growth due to the increasing frequency and sophistication of cyber threats. Organizations are recognizing the necessity of advanced security measures to protect sensitive data and maintain operational integrity. In 2025, it is estimated that cybercrime could cost businesses globally over $10 trillion annually, prompting Spanish companies to invest in security analytics solutions. This trend indicates a heightened awareness of vulnerabilities and the need for proactive measures. As a result, the demand for security analytics tools is likely to surge, as businesses seek to mitigate risks and enhance their cybersecurity posture. The security analytics market is thus positioned for significant expansion as organizations prioritize safeguarding their digital assets.

Increased Cloud Adoption

The shift towards cloud computing is reshaping the security analytics market in Spain. As more organizations migrate their operations to the cloud, the need for effective security measures becomes paramount. Cloud environments present unique challenges, including data breaches and unauthorized access, which necessitate advanced security analytics solutions. By 2025, it is projected that over 70% of Spanish businesses will utilize cloud services, creating a substantial demand for security analytics tools tailored for cloud environments. This trend indicates a growing recognition of the importance of securing cloud-based assets. The security analytics market is thus likely to expand as organizations seek to implement comprehensive security strategies that encompass both on-premises and cloud infrastructures.

Growing Regulatory Landscape

The evolving regulatory landscape in Spain is significantly influencing the security analytics market. With regulations such as the General Data Protection Regulation (GDPR) and the National Cybersecurity Strategy, organizations are compelled to adopt robust security measures. Compliance with these regulations often necessitates the implementation of advanced security analytics solutions to monitor and protect sensitive information. In 2025, it is anticipated that compliance-related investments in security technologies will account for approximately 30% of total cybersecurity spending in Spain. This trend underscores the importance of security analytics in ensuring regulatory adherence, thereby driving growth in the market. The security analytics market is thus becoming increasingly intertwined with compliance requirements, shaping the strategies of organizations across various sectors.

Rising Awareness of Data Privacy

The increasing awareness of data privacy among consumers and businesses is driving the security analytics market in Spain. As individuals become more conscious of their personal information and its protection, organizations are compelled to enhance their security measures. This heightened awareness is reflected in the growing demand for security analytics solutions that can provide insights into data handling practices and potential vulnerabilities. In 2025, it is estimated that 60% of Spanish consumers will prioritize data privacy when choosing service providers, influencing companies to invest in security analytics tools. The security analytics market is thus responding to this shift in consumer expectations, as organizations strive to build trust and ensure compliance with data protection standards.

Integration of AI and Machine Learning

The integration of artificial intelligence (AI) and machine learning (ML) technologies is transforming the security analytics market in Spain. These technologies enable organizations to analyze vast amounts of data in real-time, identifying potential threats more efficiently. By 2025, it is projected that AI-driven security solutions could reduce incident response times by up to 50%. This capability is particularly crucial for Spanish enterprises, which face increasing regulatory pressures to protect customer data. The security analytics market is adapting to these technological advancements, as companies seek to leverage AI and ML for enhanced threat detection and response. Consequently, the demand for sophisticated analytics tools is expected to rise, reflecting a broader trend towards automation in cybersecurity.