Increased Regulatory Scrutiny

The security analytics market is also being shaped by increased regulatory scrutiny surrounding data protection and privacy. In the UK, regulations such as the General Data Protection Regulation (GDPR) have heightened the focus on data security, compelling organisations to implement comprehensive security analytics solutions. Compliance with these regulations is not merely a legal obligation; it is also a critical component of maintaining customer trust. As organisations strive to meet regulatory requirements, investments in security analytics tools are expected to rise. The market is likely to see a growth rate of 12% as businesses prioritise compliance and risk management, thereby reinforcing the importance of security analytics in their overall security strategies.

Growing Cyber Threat Landscape

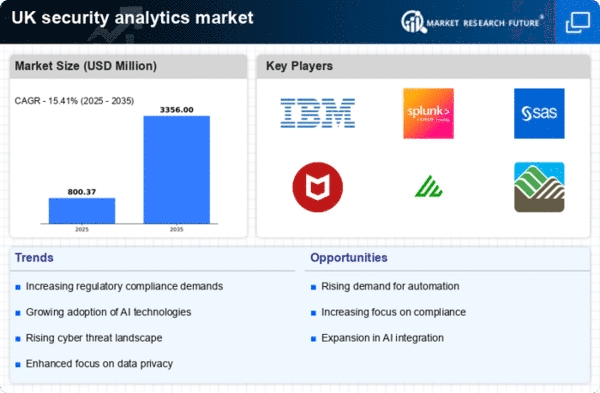

The security analytics market is experiencing heightened demand due to the escalating cyber threat landscape in the UK. With cyberattacks becoming increasingly sophisticated, organisations are compelled to adopt advanced security analytics solutions to safeguard their data and infrastructure. Reports indicate that the UK has witnessed a surge in cyber incidents, with a notable increase of 30% in reported breaches over the past year. This alarming trend underscores the necessity for robust security measures, driving investments in analytics tools that can provide real-time threat detection and response capabilities. As businesses strive to protect sensitive information, the security analytics market is expected to grow substantially, with projections suggesting a compound annual growth rate (CAGR) of 15% over the next five years.

Emergence of Remote Work Culture

The emergence of a remote work culture has transformed the security landscape, driving demand for security analytics solutions. As organisations in the UK adapt to flexible work arrangements, the need for robust security measures to protect remote access points has become paramount. This shift has led to an increased focus on endpoint security and network monitoring, both of which are integral to the security analytics market. Reports suggest that 70% of UK businesses are investing in security analytics to address vulnerabilities associated with remote work. This trend indicates a growing recognition of the need for comprehensive security strategies that encompass both on-premises and remote environments, further propelling the growth of the security analytics market.

Integration of Advanced Technologies

The integration of advanced technologies such as artificial intelligence (AI) and machine learning (ML) is significantly influencing the security analytics market. These technologies enhance the ability to analyse vast amounts of data, enabling organisations to identify potential threats more effectively. In the UK, businesses are increasingly leveraging AI-driven analytics to improve their security posture. The market for AI in cybersecurity is expected to reach £2 billion by 2026, reflecting a growing recognition of the value that these technologies bring to the security analytics market. By automating threat detection and response processes, organisations can reduce response times and mitigate risks, thereby fostering a more secure digital environment.

Rising Demand for Cloud Security Solutions

The shift towards cloud computing has created a pressing need for enhanced security measures, propelling the security analytics market forward. As more organisations in the UK migrate their operations to the cloud, the demand for cloud security solutions has surged. According to recent estimates, the cloud security market is projected to grow by 20% annually, with security analytics playing a crucial role in this transformation. Businesses are increasingly adopting cloud-based security analytics tools to gain visibility into their cloud environments and detect anomalies in real-time. This trend indicates a broader recognition of the importance of integrating security analytics into cloud strategies, ensuring that organisations can effectively manage risks associated with cloud adoption.