Adoption of Advanced Technologies

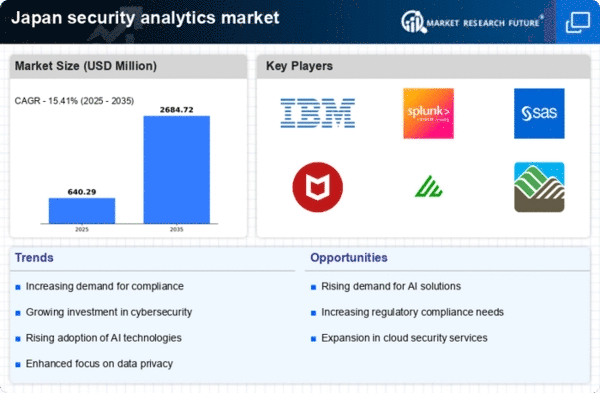

The adoption of advanced technologies, such as artificial intelligence and machine learning, is propelling the security analytics market in Japan. These technologies enable organizations to analyze vast amounts of data, identify anomalies, and respond to threats more effectively. As businesses increasingly rely on digital platforms, the need for sophisticated security analytics solutions becomes evident. The market is projected to witness substantial growth, with estimates suggesting a CAGR of over 15% through 2027. This trend indicates that organizations are recognizing the value of integrating advanced technologies into their security frameworks, thereby enhancing their ability to combat emerging threats in the digital landscape.

Growing Awareness of Data Privacy

The growing awareness of data privacy among consumers and businesses in Japan is driving the security analytics market. As individuals become more conscious of their personal information and its potential misuse, organizations are compelled to adopt security measures that protect sensitive data. This heightened awareness is leading to increased scrutiny of data handling practices, prompting businesses to invest in security analytics solutions that ensure data integrity and confidentiality. The market is likely to expand as companies strive to build trust with their customers by demonstrating a commitment to data privacy. This trend reflects a broader societal shift towards valuing security and privacy in the digital age.

Increasing Cyber Threat Landscape

The escalating cyber threat landscape in Japan is a primary driver for the security analytics market. With cyberattacks becoming more sophisticated, organizations are compelled to adopt advanced security measures. Reports indicate that cybercrime costs in Japan could reach ¥1 trillion by 2025, highlighting the urgency for robust security solutions. The need for real-time threat detection and response mechanisms is paramount, as businesses seek to protect sensitive data and maintain operational integrity. Consequently, investments in security analytics tools are likely to surge, as companies aim to enhance their cybersecurity posture. This trend underscores the critical role of security analytics market solutions in mitigating risks associated with cyber threats.

Regulatory Pressures and Compliance

Regulatory pressures in Japan are significantly influencing the security analytics market. Organizations are increasingly required to comply with stringent data protection laws, such as the Act on the Protection of Personal Information (APPI). Non-compliance can result in hefty fines, prompting businesses to invest in security analytics solutions that ensure adherence to these regulations. The market is expected to grow as companies prioritize compliance-driven security measures. Furthermore, the Japanese government is actively promoting cybersecurity initiatives, which may further drive demand for security analytics tools. As a result, organizations are likely to allocate more resources towards implementing effective security analytics strategies to navigate the complex regulatory landscape.

Expansion of Digital Transformation Initiatives

The ongoing expansion of digital transformation initiatives across various sectors in Japan is a significant driver for the security analytics market. As organizations embrace digital technologies to enhance operational efficiency, they also face increased cybersecurity risks. The integration of digital tools necessitates robust security measures to safeguard against potential threats. Reports suggest that the digital transformation market in Japan is expected to exceed ¥10 trillion by 2025, indicating a substantial investment in technology. Consequently, the demand for security analytics solutions is likely to rise, as businesses seek to protect their digital assets and ensure the security of their operations in an increasingly interconnected environment.