Government Initiatives and Funding

Government initiatives aimed at improving healthcare access and funding for respiratory health are crucial drivers for the respiratory drugs market. In Spain, the government has implemented various programs to enhance the management of respiratory diseases, including increased funding for research and development of new therapies. The Spanish Ministry of Health has allocated approximately €50 million for respiratory health initiatives in the past year, which includes support for clinical trials and the development of innovative drugs. Such financial backing is likely to stimulate growth in the respiratory drugs market, as it encourages pharmaceutical companies to invest in research and bring new products to market. Furthermore, public health campaigns aimed at raising awareness about respiratory diseases are expected to increase patient engagement and demand for effective treatments.

Advancements in Drug Delivery Technologies

Technological innovations in drug delivery systems are significantly influencing the respiratory drugs market. The development of advanced inhalation devices, such as dry powder inhalers and nebulizers, enhances the efficacy and patient compliance of respiratory medications. These devices allow for targeted delivery of drugs directly to the lungs, improving therapeutic outcomes. In Spain, the market for inhalation devices is expected to grow at a CAGR of 6% over the next five years, driven by the increasing adoption of these technologies. Additionally, the integration of smart technology in inhalers, which provides real-time feedback to patients, is likely to further enhance adherence to treatment regimens. This trend suggests that advancements in drug delivery are not only improving patient outcomes but also expanding the overall respiratory drugs market.

Emerging Market for Biologics and Biosimilars

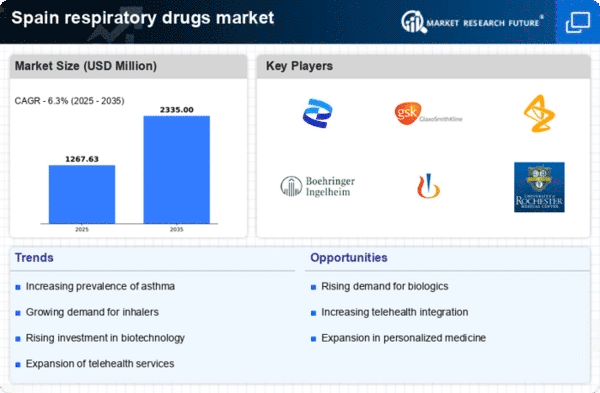

The emergence of biologics and biosimilars is reshaping the landscape of the respiratory drugs market. These advanced therapies offer new treatment options for patients with severe asthma and other respiratory conditions. In Spain, the market for biologics is projected to grow significantly, with an expected CAGR of 8% over the next five years. The introduction of biosimilars is also anticipated to enhance market accessibility by providing cost-effective alternatives to expensive biologic therapies. This shift towards biologics and biosimilars is likely to attract both patients and healthcare providers, as they seek more effective and affordable treatment options. Consequently, the respiratory drugs market is poised for expansion as these innovative therapies gain traction among healthcare professionals and patients alike.

Increasing Prevalence of Respiratory Diseases

The rising incidence of respiratory diseases in Spain is a primary driver for the respiratory drugs market. Conditions such as asthma and chronic obstructive pulmonary disease (COPD) are becoming more prevalent, affecting a significant portion of the population. According to recent health statistics, approximately 10% of the Spanish population suffers from asthma, while COPD affects around 3% of adults. This growing patient base necessitates the development and availability of effective respiratory drugs, thereby propelling market growth. Furthermore, the aging population in Spain, which is projected to reach 25% of the total population by 2030, is likely to exacerbate the demand for respiratory therapies. As a result, pharmaceutical companies are increasingly focusing on innovative solutions to address these health challenges, indicating a robust future for the respiratory drugs market in Spain.

Rising Awareness and Education on Respiratory Health

The growing awareness and education surrounding respiratory health issues are driving the respiratory drugs market in Spain. Public health campaigns and educational programs have been instrumental in informing the population about the risks and management of respiratory diseases. As awareness increases, more individuals are seeking medical advice and treatment for their conditions. This trend is reflected in the rising number of prescriptions for respiratory medications, which has seen an increase of approximately 15% over the last two years. Healthcare professionals are also becoming more proactive in diagnosing and treating respiratory conditions, further contributing to market growth. The emphasis on education and awareness is likely to continue, suggesting a sustained demand for respiratory drugs in the coming years.